This list of small business tax deductions will prepare you for your conversations with bookkeepers accountants and tax experts.

2014 tax chairs irs.

October 13 2015.

A means of escape or evasion.

For the connecticut state tax panel.

A means or opportunity of evading a rule law etc.

Paying taxes is never a fun prospectand paying estimated taxes depending on your level of income generally adds to the stress and can reach an unsettling degree of complexity.

What Is The Minimum Monthly Payment For An Irs Installment

Save On Taxes Keep What You Have Investment U

How Do I File Back Tax Returns Turbotax Tax Tips Videos

5 Items To Donate For A Charitable Tax Deduction Personal

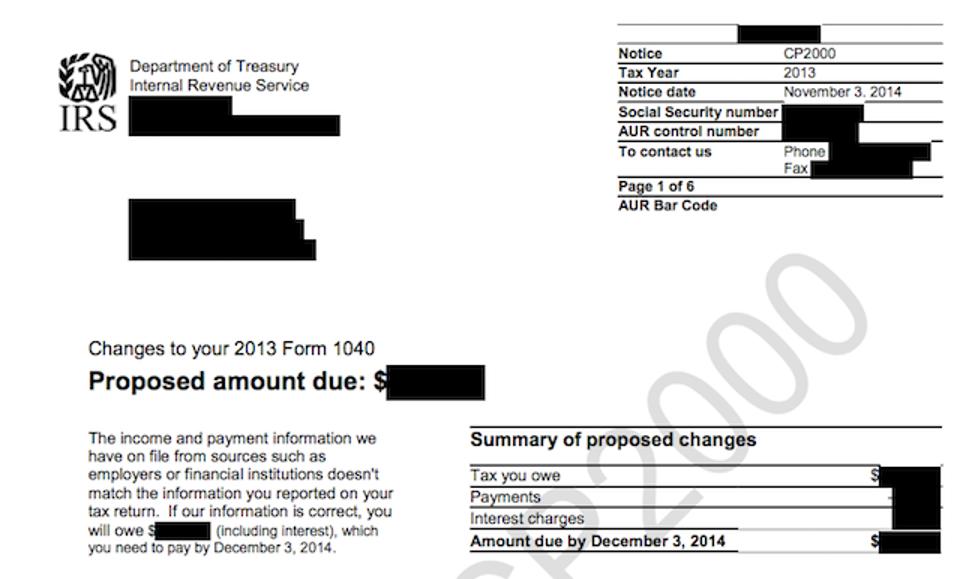

Receive An Irs Cp 2000 Notice Beware Dopkins Co Llp

Thieves Hack Irs Steal Tax Info From More Than 100 000

Being Audited By Irs For Mileage Fillable Printable Tax

Untitled

Secrets Of Claiming A Home Office Deduction

Mistrial Declared In Case Against Oregon Man Who Cited

How Does The Government Shutdown Affect Tax Season The

Irs Stock Photos Irs Stock Images Alamy

4 Myths About The Home Office Tax Deduction Money

Penalties Tax Expatriation

15 Fortune 500 Companies Paid No Federal Income Taxes In

Irs Tax Forms Tax Changes Tom Copeland S Taking Care Of

Tax Audit Red Flags Avoid These Mistakes When Your Return

Trump Tax Returns New York Pursues Law To Make Records

Famous People Tax Expatriation

April 2014 Tax Expatriation

2018 Tax Postcard Western Cpe

Robert E Mckenzie Chicago Tax Attorney Arnstein Lehr

Checklist For Irs Form 4562 Depreciation 2016 Tom

Charles Rettig Wikipedia

Freetaxusa Best Tax Software Deluxe Online Tax Program

Five Options For When You Owe Taxes And Can T Pay Right

Ihre Psd Bank Foreign Account Tax Compliance Act Fatca

Congress Moves Toward Its Biggest Irs Overhaul In Two

Us Lawmakers Strongly Urge Irs To Update Crypto Tax

Why The Irs Is Legally Required To Give Congress Trump S Tax

Irs Budget Cuts Hurt Low Income And Elderly Taxpayers Kuow

How To Stop An Irs Bank Levy Credit Com

Uber Opens Below Ipo Price In Market Debut

How The Irs Was Gutted

Grace Periods For Retransmission Of Rejected E Filed Returns

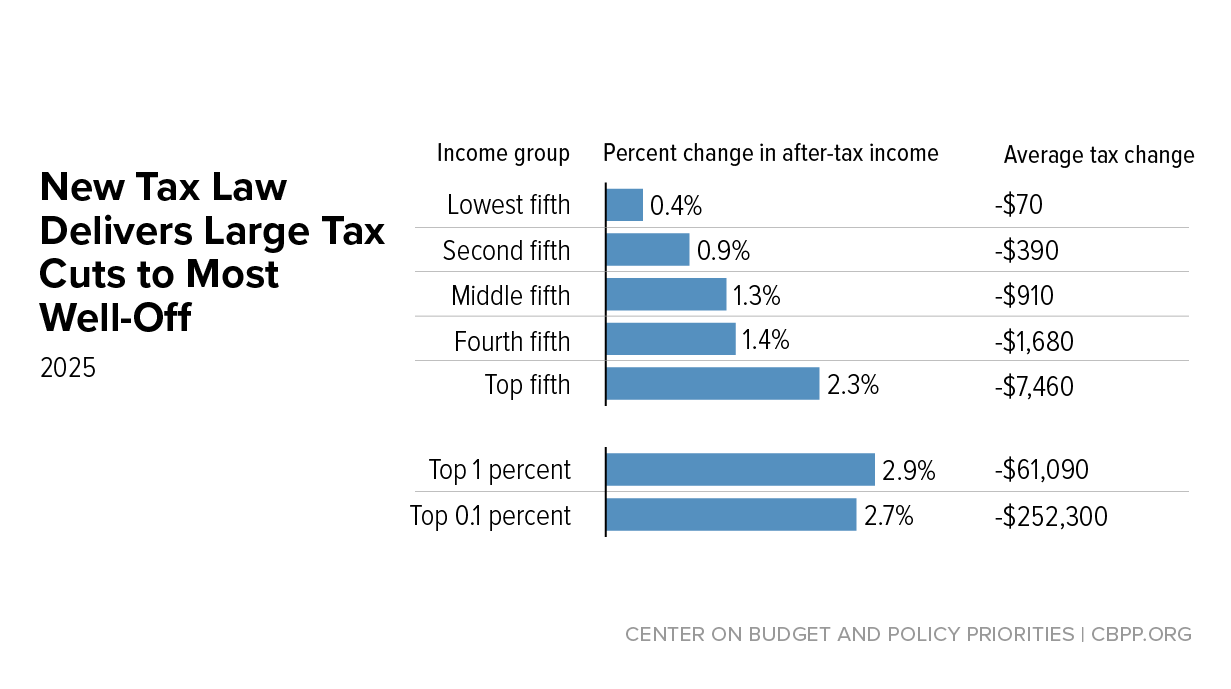

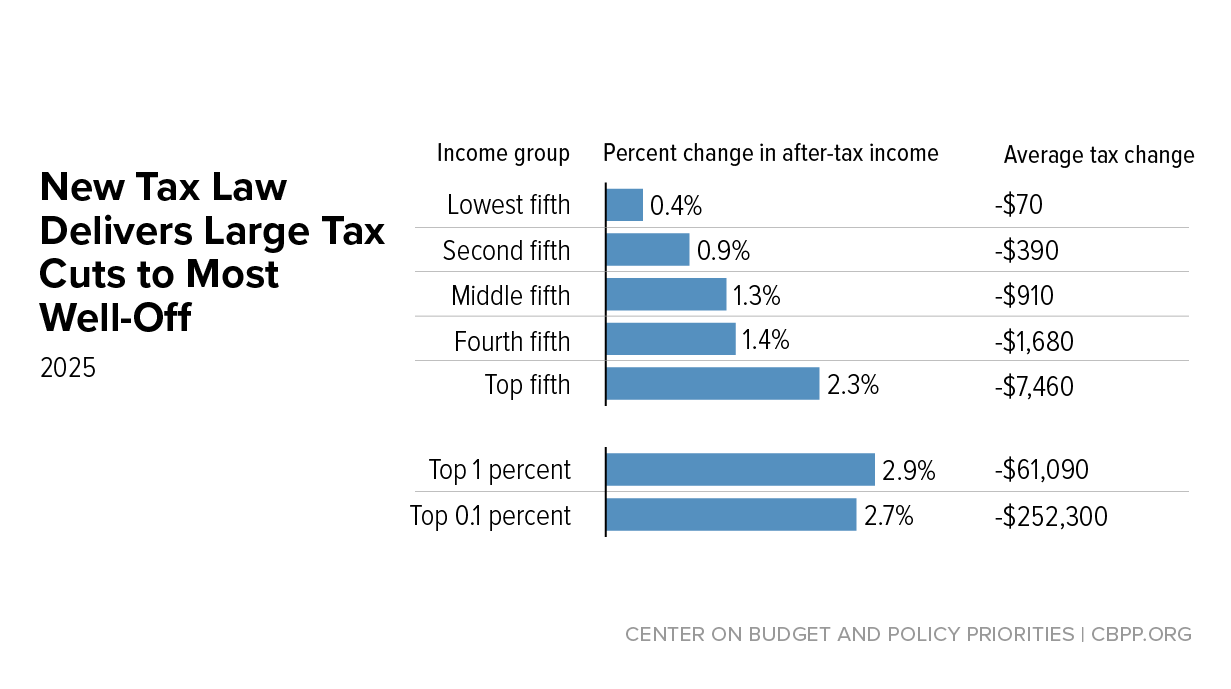

New Tax Law Is Fundamentally Flawed And Will Require Basic

How To Correct Irs State Tax Return Rejections On Efile Com

/GettyImages-550437755-56a636ec5f9b58b7d0e06e89.jpg)

Earned Income Is Taxed Differently Than Unearned Income

Surprising Small Business Tax Facts Fastupfront

Thousands Who Didn T File Tax Returns May Lose Health Care

How To File Your 2017 Tax Return In 2019 Priortax Blog

What S The Best Way To Do Your Taxes The Consumer Warning

5 Signs That An Irs Caller Is A Crook Don T Mess With Taxes

2018 Form Irs 8332 Fill Online Printable Fillable Blank

Tax Rates And Their Impact On Irs Tax Brackets For 2014

Irs Says 5 More Staffers Lost Possible Tea Party Related

Don T Ignore Irs Letters The Crusader Newspaper Group

How The Irs Was Gutted Propublica

Irs Home Office Tax Deduction Rules Calculator

Buttonow Elected As Chair Of Irs Etaac 3 Members Added

2019 Irs Tax Refund Schedule Direct Deposit Dates 2018

/GettyImages-120374479-56a939375f9b58b7d0f9624c.jpg)

How To Deduct The Cost Of Repairs And Maintenance Expenses

Ntpi Fellow Graduate November 7th 2014 Tnt Bookkeeping

Table Of Contents From Our Leader The Chair S Message

Tax Traps The Top 10 Irs Audit Triggers

Irs Pays 50k In Confidentiality Suit Politico

The Irs Tried To Take On The Ultrawealthy It Didn T Go Well

New Tax Law Is Fundamentally Flawed And Will Require Basic

2018 Federal Tax Rate Schedules Turbotax Tax Tips Videos

Irs Research Bulletin 2014 Indb

What S Happened To The Aca Penalty Tax Tax Policy Center

/450824025-F-56a938665f9b58b7d0f95be1.jpg)

Learn About Home Office Tax Deductions

The Tax Benefits For A Musician Chron Com

The Irs Has Told Congress That It Will Issue New

The Top 0 5 Underpay 50 Billion A Year In Taxes And

End Of Us Offshore Voluntary Disclosure Program In 2018

Internal Revenue Service 22 Reviews Public Services

Tax Litigation Los Angeles Irs Tax Attorneytax Attorney

Seven Things You Didn T Know About Taxes Turbotax Tax Tips

Scams To Avoid This Tax Season Consumer Reports

10 Crazy Sounding Tax Deductions Irs Says Are Legit

Irs Basically Plastering Your Social Security Numbers On

Internal Revenue Bulletin 2014 16 Internal Revenue Service

Basic Accounting Forms Irs For Your Small Business Form 8829

Is My State Tax Refund Taxable And Why The Turbotax Blog

Internal Revenue Bulletin 2014 16 Internal Revenue Service

April 2015 The Scientology Money Project

10 Surprising Items Irs Says To Report On Your Taxes

/169997690-F-56a938735f9b58b7d0f95c6d.jpg)

How To Calculate Tax Balance Due On Form 1040

Recent Developments In Individual Taxation

4 Steps If You Haven T Filed Your Taxes In A While Inc Com

When The Irs Likes Your Facebook Update Marketplace

2014 The Tax Break Shenanigans Of J Winston Krause Is J

Internal Revenue Bulletin 2014 16 Internal Revenue Service

Rich People Are Getting Away With Not Paying Their Taxes

Tax Facts And Fictions

Hillhurst Tax Group Irs Tax Attorneys 22 Photos 34

Polly Scatena Vasheresse Sater Expensing Or

Are You Responsible For Your New Spouse S Back Taxes

Steven Mnuchin Makes A Welcome Case For Boosting Irs Funding

What Would You Say In A Letter To The Irs Former Secretary

Georgia Candidate For Governor Owes Irs More Than 50k

5 Irs Penalties You Want To Avoid Turbotax Tax Tips Videos

What Would You Say In A Letter To The Irs Former Secretary

Federal Tax And Form Crimes Updated Irs Streamlined Filing

January 2018 Urbanreview St Louis

Aicpa Submits Comments To Irs On Corporate Estimated Tax

Penalties Tax Expatriation

/GettyImages-550437755-56a636ec5f9b58b7d0e06e89.jpg)

/GettyImages-120374479-56a939375f9b58b7d0f9624c.jpg)

/450824025-F-56a938665f9b58b7d0f95be1.jpg)

/169997690-F-56a938735f9b58b7d0f95c6d.jpg)