Pdf Dignity And Dreams What The Earned Income Tax Credit

For Many Middle Class Taxpayers On Obamacare It S Payback

How The Irs Knows You Didn T Report Income Cbs News

Irs Income Tax Irs Income Tax Tables 2017

Irs Tax Filing Rules Offer Eitc To Those With Disabilities

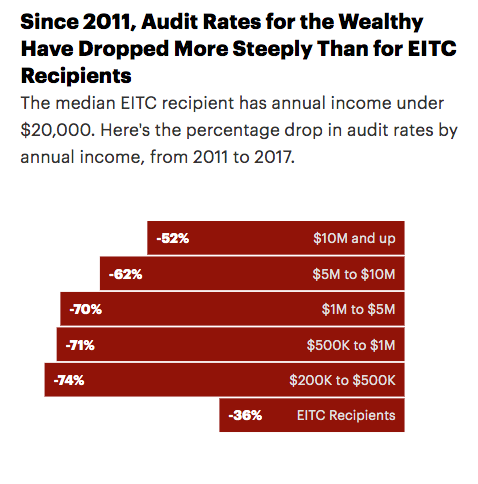

The Irs Barely Bothered To Audit Super Rich People Last Year

House Research

Rsc Cleveland Llc Posts Facebook

House Research

House Research

Understanding The New Kiddie Tax Journal Of Accountancy

You Received A Scary Irs Letter Correspondence We Can Help

How To Correct Irs State Tax Return Rejections On Efile Com

Publication 510 Rev July 2013 Internal Revenue Service

January 2018 Urbanreview St Louis

Untitled

Publication 510 Rev July 2013 Internal Revenue Service

House Research

Recent Developments In Individual Taxation

The Top 0 5 Underpay 50 Billion A Year In Taxes And

Examining The Impact Of The Federal Earned Income Tax Credit

Understanding The New Kiddie Tax Journal Of Accountancy

Taxation Representation June 4 2019 Lexology

Proof Needed To Claim Earned Income Credit

The Federal Earned Income Tax Credit And The Minnesota

15 Main Reasons Why The Irs Might Decide To Audit You

Georgia Candidate For Governor Owes Irs More Than 50k

How Plutocrats Cripple The Irs

Internal Revenue Service Advisory Council 2015 Public Report

Penalties Tax Expatriation

Irs Operations And Tax Filing Season

How The Irs Was Gutted

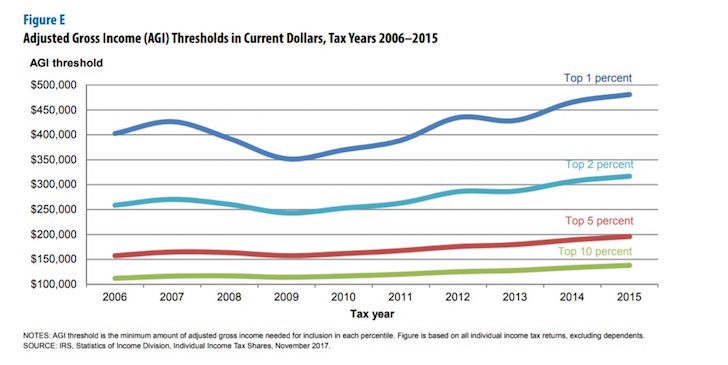

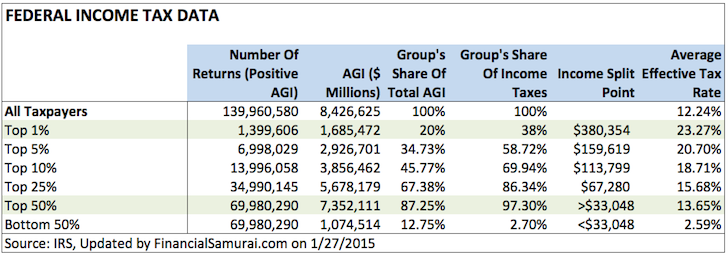

How Much Money Do The Top Income Earners Make By Percentage

California Senate Leader Toni Atkins And Assemblymember Todd

.jpg)

Taxation Representation April 9 2019

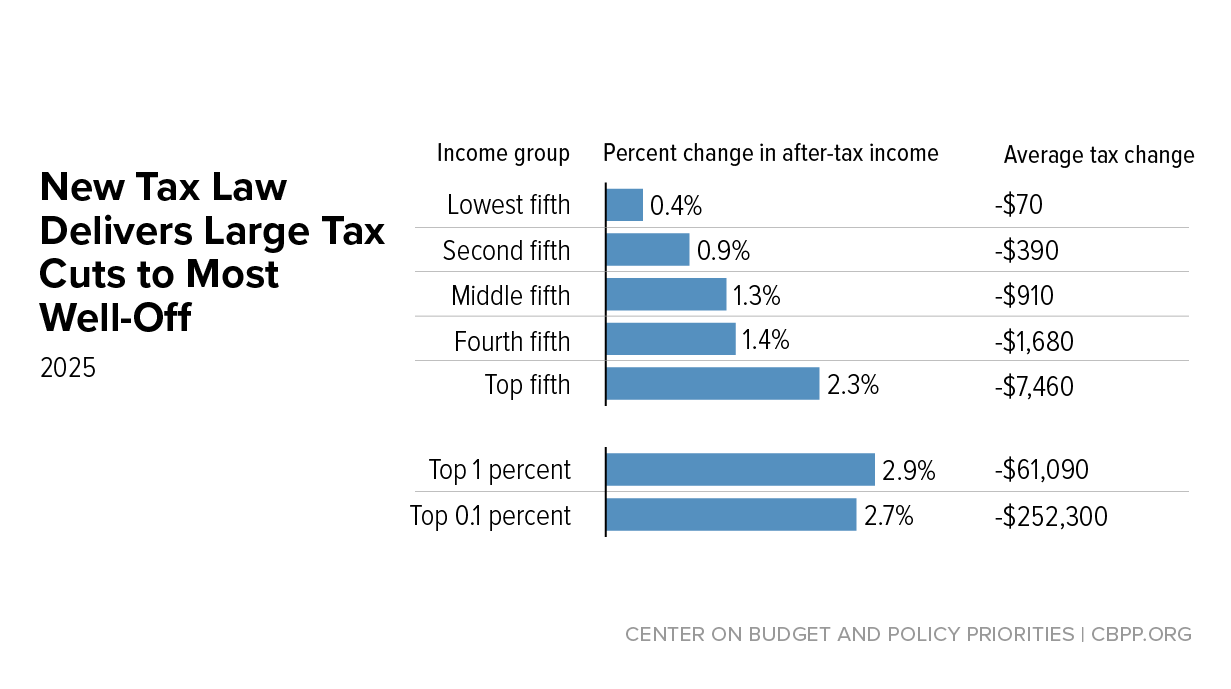

New Tax Law Is Fundamentally Flawed And Will Require Basic

199a Regulations Irs 199a Allows 20 Qbi Deductions In

Tax Traps The Top 10 Irs Audit Triggers

Who S More Likely To Be Audited A Person Making 20 000

Understanding The New Kiddie Tax Journal Of Accountancy

3 Best Tax Deductions To Target And 3 To Avoid Credit Karma

The Irs Has Been Weaponized Against The Working Poor Truthdig

Irs Red Flags That Put Your Tax Return At Risk For An Audit

Tax Hacks 2015 Don T Overlook These 8 Deductions And

Who S More Likely To Be Audited A Person Making 20 000

Plan Before Making A Move Expatriating Mid Tax Year

How The Irs Was Gutted Talking Points Memo

Irs Income Tax Audit Chances Are Slim Except For These

H I R E Inc Hispanic Internal Revenue Employees Inc

Internal Revenue Bulletin 2014 16 Internal Revenue Service

4 Reasons To File Taxes Early And Electronically Especially

Internal Revenue Bulletin 2014 16 Internal Revenue Service

Irs Home Office Tax Deduction Rules Calculator

10 Surprising Items Irs Says To Report On Your Taxes

1 In 3 Are Filing Taxes Late In Tax Season H R Block Newsroom

Penalties Tax Expatriation

Internal Revenue Bulletin 2014 16 Internal Revenue Service

Penalties Tax Expatriation

/GettyImages-4869596531-5a7cc386642dca0037585aee.jpg)

Tax Loopholes And How To Use Them

How A Benefit For The Working Poor Was Turned Against Them

/GettyImages-540204814-5766e4423df78ca6e4d8ca6c.jpg)

Reporting Capital Gains And Losses To The Irs Form 8949

State Income Tax Wikipedia

Ckeep Provides Free Tax Assistance United Way Of The Bluegrass

Irs Income Tax Audit Chances Are Slim Except For These

Requesting An Irs Transcript Financial Aid Sacramento

House Budget Committee Proposal To Verify Incomes Of All

/cdn.vox-cdn.com/uploads/chorus_image/image/48040351/shutterstock_207055495.0.jpg)

Here S An Amazingly Simple Way To Cut Poverty Vox

Building On The Success Of The Earned Income Tax Credit

Steven Mnuchin Makes A Welcome Case For Boosting Irs Funding

Shocked By Your Tax Return In 2019 Here S What You Should

Why Work With A Pro On Your Expatriate Tax Return

New Tax Law Is Fundamentally Flawed And Will Require Basic

Estimated Taxes Common Questions Turbotax Tax Tips Videos

You Received A Scary Irs Letter Correspondence We Can Help

Who S More Likely To Be Audited A Person Making 20 000 Or

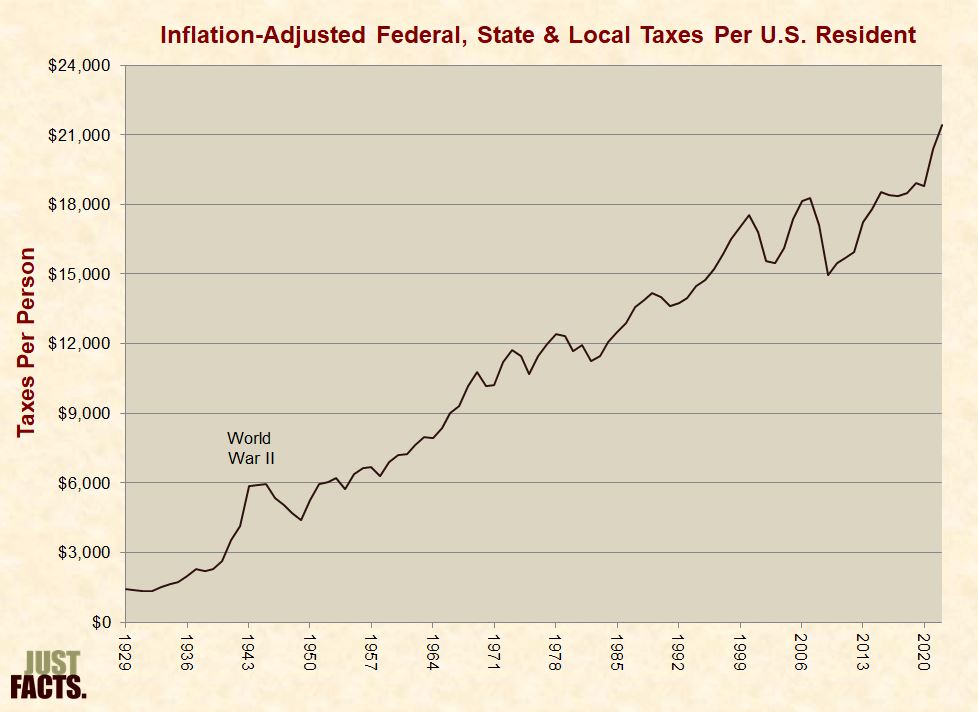

Taxes Just Facts

How Mortgage Lenders Calculate Self Employment Income My

How Much Money Do The Top Income Earners Make By Percentage

Advisorselect Fy 2016 Federal Tax Proposed Budget Or 2016

/HeroImagesGettyImages-65a9475bbae746848eee99e8fff09f2d.jpg)

15 Tax Deductions And Benefits For The Self Employed

2019 Irs Tax Refund Schedule Direct Deposit Dates 2018

Tax Season Start Filing Your Taxes Now La Cooperativa

Key Numbers To Know For Your 2014 Federal Tax Return

4 Steps If You Haven T Filed Your Taxes In A While Inc Com

State Income Tax Wikipedia

House Republicans Blame Their Own Failures On The Irs Neil

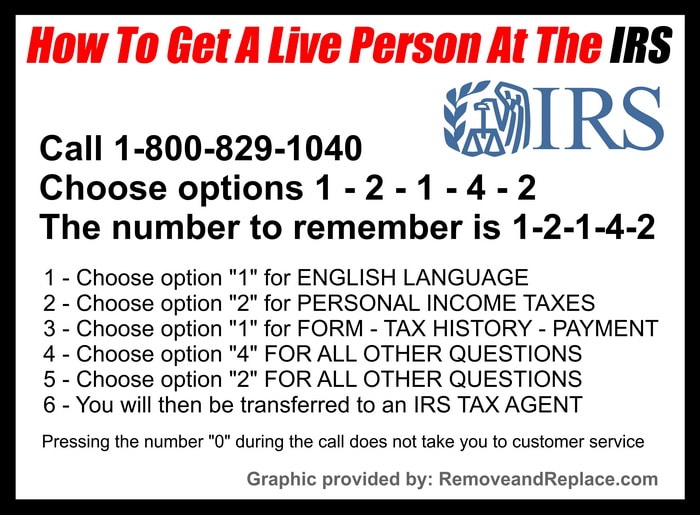

Irs 1800 Phone Numbers How To Speak With A Live Irs Person

Gao 18 20 Identity Theft Improved Collaboration Could

The Irs Barely Bothered To Audit Super Rich People Last Year

E File Your 1040 Ez Tax Form For Free Online Consumer Reports

/cdn.vox-cdn.com/uploads/chorus_image/image/46754966/eitc.0.png)

America S Best Program For The Poor May Be Even Better Than

The Eitc Gives Low Income Americans More Than Just Money

H I R E Inc Hispanic Internal Revenue Employees Inc

Doctors Have The Power To Help Their Patients Thrive Financially

10 Tax Audit Red Flags

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/4944189/worksheet.jpg)

Here S An Amazingly Simple Way To Cut Poverty Vox

:format(jpeg)/cdn.vox-cdn.com/uploads/chorus_image/image/48040351/shutterstock_207055495.0.jpg)

Here S An Amazingly Simple Way To Cut Poverty Vox

Low Income Taxpayer Clinic Litc