If you claim the earned income tax credit eitc or the additional child tax credit actc on your tax return by law the irs cant issue your refund before mid february even the portion not associated with eitc or actc.

Irs earned income credit chair.

Department of the treasury internal revenue service forms website.

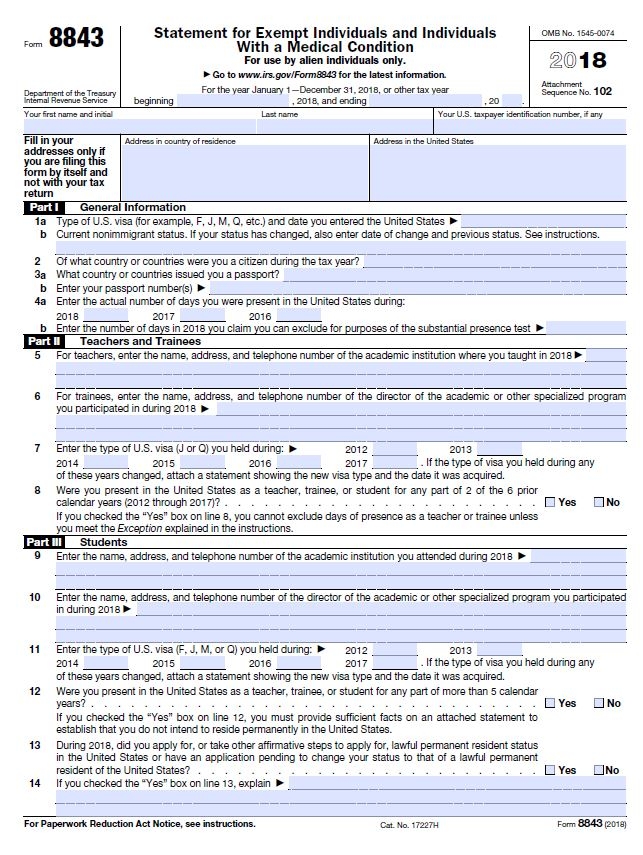

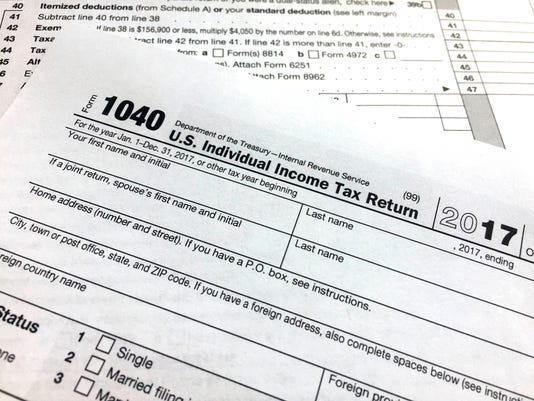

Download a pdf version of the latest irs form 1040 down below or find it on the us.

This is not a tax table.

See the earned income tax credit table below to see if you qualify for the income phase out limits.

Upon completion of the tool you will have the option to view or print a summary of the information you gave us your filing status your income the number of qualifying children if any and an estimate of your earned income tax credit.

A tax credit means more money in your pocket.

Then go to the column that includes your filing status and the number of qualifying children you have.

It reduces the amount of tax you owe and may also give you a refund.

Eitc earned income tax credit is a benefit for working people who have low to moderate income.

See earned income tax credit eitc income limits and maximum credit amounts.

2018 earned income credit eic table caution.

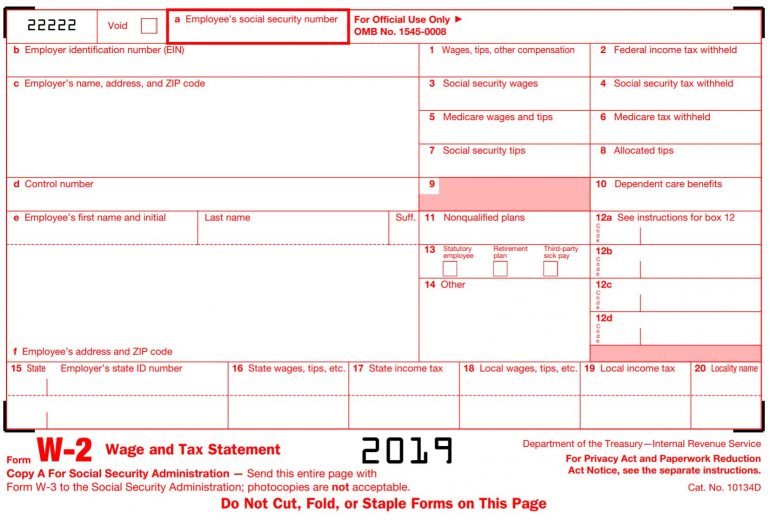

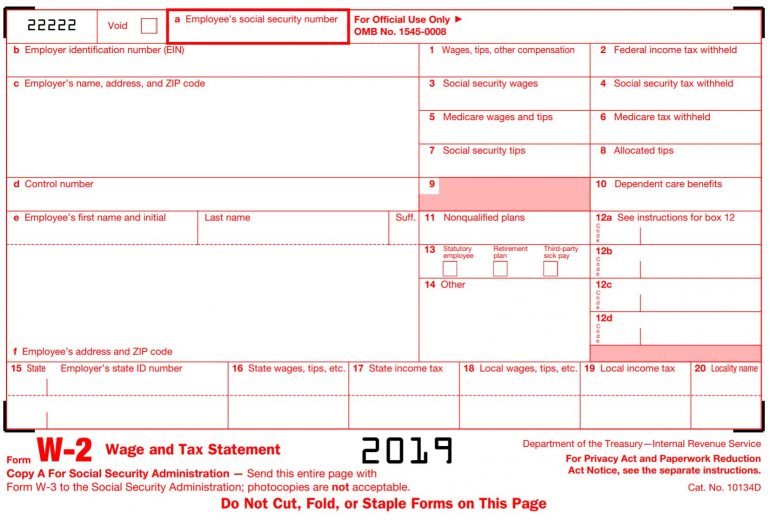

The amount of your nontaxable combat pay should be shown on your form w 2 in box 12 with code q.

It is also simultaneously one of the most complicated and popular tax credits as well.

Electing to include nontaxable combat pay in earned income may increase or decrease your eitc.

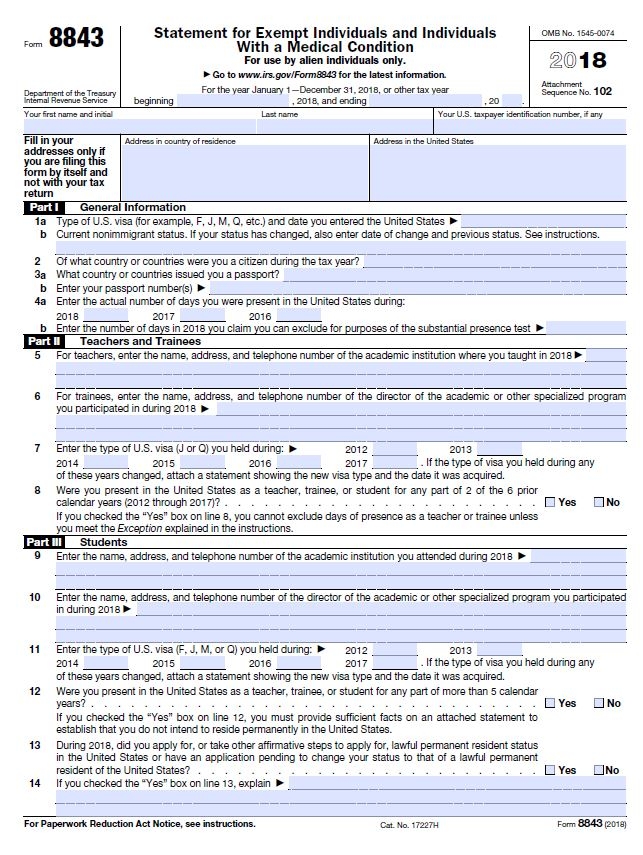

Not file a foreign earned income form 2555 or foreign earned income exclusion have earned income and adjusted gross income within the irs limits.

Eitc reduces the amount of tax you owe and may give you a refund.

The earned income tax credit eitc or eic is a benefit for working people with low to moderate income.

Department of the treasury internal revenue service.

Irs form 1040 or the schedule eic earned income credit is a form issued by the us.

Enter the credit from that column on your eic worksheet.

Roth Ira Limit Rules For 2019 Bankrate Com

/cdn.vox-cdn.com/uploads/chorus_image/image/62864694/897291366.jpg.0.jpg)

Government Shutdown 2019 How Tax Refunds And Returns Will

2007 Earned Income Tax Credit Table Irs Eic Table 2018 6

How To File An Extension For Taxes 14 Steps With Pictures

House Research

Understanding The New Kiddie Tax Journal Of Accountancy

The Eitc Has Bipartisan Support Utpol Fighting Poverty

Unclaimed Irs Tax Refunds How To Get Your Lost Cash Abc News

File Your Taxes Before Scammers Do It For You Krebs On

Vita Anne Arundel Community College

Why Work With A Pro On Your Expatriate Tax Return

Rich People Are Getting Away With Not Paying Their Taxes

Understanding The New Kiddie Tax Journal Of Accountancy

Irs Income Tax Audit Chances Are Slim Except For These

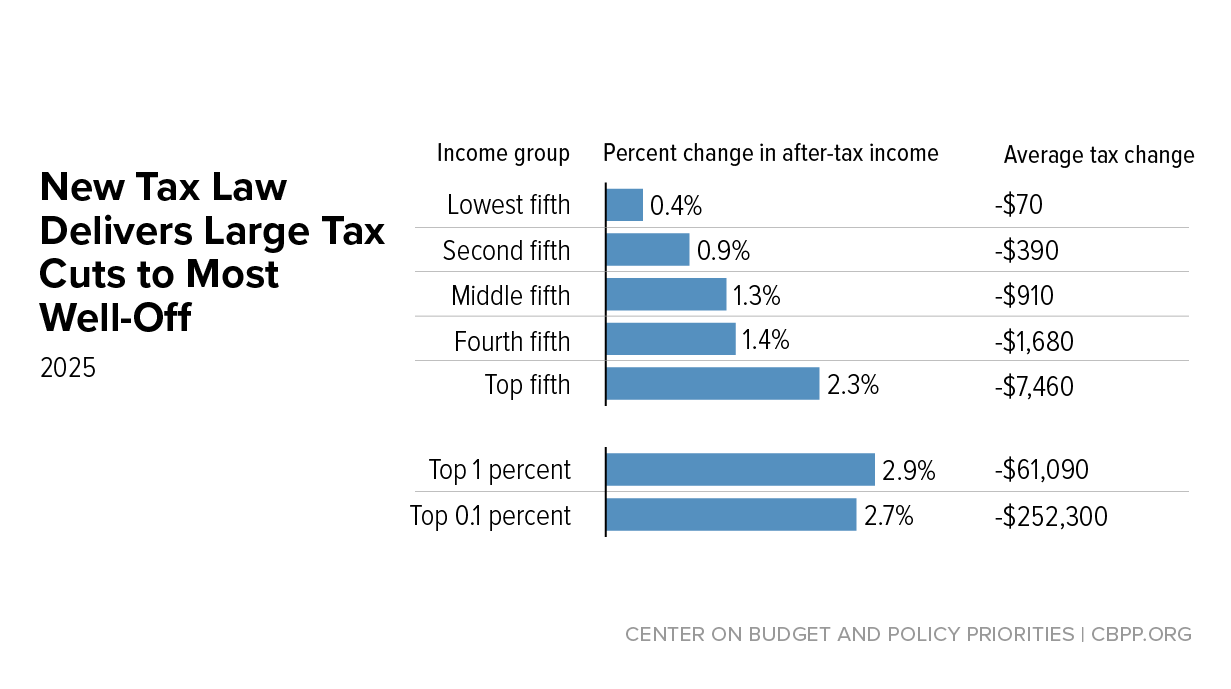

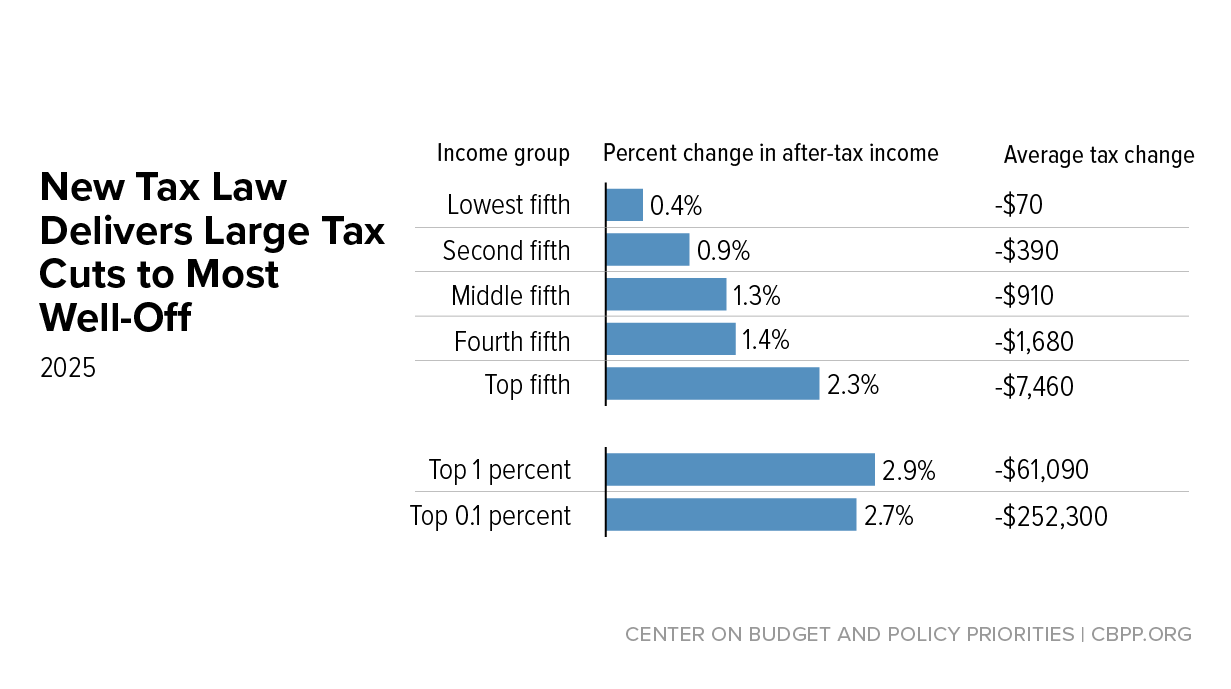

New Tax Law Is Fundamentally Flawed And Will Require Basic

Publication 584 02 2019 Casualty Disaster And Theft

Irs Home Office Tax Deduction Rules Calculator

The New Irs Tax Forms Are Out Here S What You Should Know

Taxpayers Who Filed Tax Returns In U S Virgin Islands Enjoy

4 Steps If You Haven T Filed Your Taxes In A While Inc Com

Pdf Dignity And Dreams What The Earned Income Tax Credit

Twickett S Blog United Way Of Southern Cameron County

Unclaimed Irs Tax Refunds How To Get Your Lost Cash Abc News

The Gop Wants The Irs To Crack Down On The Working Poor

Irs Warns On Dirty Dozen Tax Scams James Hamlin Co P C

Who S More Likely To Be Audited A Person Making 20 000

Proof Needed To Claim Earned Income Credit

Surviving A Salon Or Spa Irs Audit Cash Really Counts

2019 Irs Tax Refund Schedule Direct Deposit Dates 2018

:format(png)/cdn.vox-cdn.com/uploads/chorus_image/image/46754966/eitc.0.png)

America S Best Program For The Poor May Be Even Better Than

Irs Income Tax Irs Income Tax Tables 2017

Irs Income Tax Audit Chances Are Slim Except For These

Working For Yourself What To Know About Irs Schedule C

Irs Hobby Income Get It Deducted As A Business If It Qualifies

Irs Red Flags That Put Your Tax Return At Risk For An Audit

Irs Office Near Me How To Find One Credit Karma

You Received A Scary Irs Letter Correspondence We Can Help

House Research

2018 Tax Postcard Western Cpe

:brightness(10):contrast(5):no_upscale()/GettyImages-540204814-5766e4423df78ca6e4d8ca6c.jpg)

Reporting Capital Gains And Losses To The Irs Form 8949

Plan Before Making A Move Expatriating Mid Tax Year

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/4944189/worksheet.jpg)

Here S An Amazingly Simple Way To Cut Poverty Vox

How The Irs Was Gutted

Building On The Success Of The Earned Income Tax Credit

Figure Out Take Home Pay From New Irs Tables Consumer Reports

/she-handles-the-bills-in-this-home-638771304-5a7fe3f0eb97de0037293c18.jpg)

Paying Taxes On Cd Interest Maturity Or Withdrawals

2007 Earned Income Tax Credit Table Irs Eic Table 2018 6

/cdn.vox-cdn.com/uploads/chorus_image/image/48040351/shutterstock_207055495.0.jpg)

Here S An Amazingly Simple Way To Cut Poverty Vox

199a Regulations Irs 199a Allows 20 Qbi Deductions In

/HeroImagesGettyImages-65a9475bbae746848eee99e8fff09f2d.jpg)

15 Tax Deductions And Benefits For The Self Employed

State Income Tax Wikipedia

Irs Works To Wrap Up International Rules This Summer

Irs Accepting E Files File Your Taxes Today The Turbotax

How Legal Immigrants Can Claim U S Tax Credits Cbs News

Ckeep United Way Of The Bluegrass

/GettyImages-550437755-56a636ec5f9b58b7d0e06e89.jpg)

Earned Income Is Taxed Differently Than Unearned Income

Congress Moves Toward Its Biggest Irs Overhaul In Two

How Does A Tax Credit Affect My Taxes Finance Zacks

/GettyImages-591954317-576c70c93df78cb62c7184ca.jpg)

Can Two Parents Both Claim The Same Dependent

House Research

Can The Irs Garnish My 1099 Earnings Tax Problem Solver

Alexandria Ocasio Cortez Suggests The Irs Should Do Your

Internal Revenue Bulletin 2014 16 Internal Revenue Service

How To Correct Irs State Tax Return Rejections On Efile Com

Understanding The New Kiddie Tax Journal Of Accountancy

Irs Audits Tax Money Collected Drops When The Agency S

Income Tax Assistance

The Top 0 5 Underpay 50 Billion A Year In Taxes And

Earned Income Tax Credit Biggest Tax Refund Consumer Reports

Earned Income Tax Credit City Of Detroit

New Tax Law Is Fundamentally Flawed And Will Require Basic

10 Surprising Items Irs Says To Report On Your Taxes

2007 Earned Income Tax Credit Table Irs Eic Table 2018 6

Caleitc Atcaa

A Mid Year Tax Legislation Update Accounting Today

Charles Rettig Wikipedia

The Gop Wants The Irs To Crack Down On The Working Poor

It S Tax Time These Are The Top Dirty Dozen Irs Scams Of

The Go Curry Cracker 2018 Taxes Go Curry Cracker

What Is A W 2 Form How To Read And Understand It In 2019

You Received A Scary Irs Letter Correspondence We Can Help

Who S More Likely To Be Audited A Person Making 20 000

/minority-interest-income-statement-5954ad873df78cdc29246f3d.jpg)

Timing Business Income And Expenses At Tax Year End

4 Reasons To File Taxes Early And Electronically Especially

Caleitc Atcaa

Internal Revenue Bulletin 2014 16 Internal Revenue Service

Penalties Tax Expatriation

The J1 Student S Bullsh T Free Guide To Tax In The Us

Steven Mnuchin Makes A Welcome Case For Boosting Irs Funding

Is Social Security Taxable The Motley Fool

1 In 3 Are Filing Taxes Late In Tax Season H R Block Newsroom

Tax Traps The Top 10 Irs Audit Triggers

Irs Tax Filing Rules Offer Eitc To Those With Disabilities

/u-s-tax-filing-1090495926-e2d35df4094146a587089d7b3158e64c.jpg)

Types Of Income The Irs Can T Touch

Irs Answers Wisconsin Readers Questions About Changes In

Irs Inflation Adjustments For 2019 Mileiq

What You Need To Know About The Fmla Tax Credit Primepay

The 1040 The Schedule C Part Ii Expenses Taxes Are Easy

![]()

/cdn.vox-cdn.com/uploads/chorus_image/image/62864694/897291366.jpg.0.jpg)

:format(png)/cdn.vox-cdn.com/uploads/chorus_image/image/46754966/eitc.0.png)

:brightness(10):contrast(5):no_upscale()/GettyImages-540204814-5766e4423df78ca6e4d8ca6c.jpg)

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/4944189/worksheet.jpg)

/she-handles-the-bills-in-this-home-638771304-5a7fe3f0eb97de0037293c18.jpg)

/cdn.vox-cdn.com/uploads/chorus_image/image/48040351/shutterstock_207055495.0.jpg)

/HeroImagesGettyImages-65a9475bbae746848eee99e8fff09f2d.jpg)

/GettyImages-550437755-56a636ec5f9b58b7d0e06e89.jpg)

/GettyImages-591954317-576c70c93df78cb62c7184ca.jpg)

/minority-interest-income-statement-5954ad873df78cdc29246f3d.jpg)

/u-s-tax-filing-1090495926-e2d35df4094146a587089d7b3158e64c.jpg)