House democrats subpoenaed president donald trumps lawyer rudy giuliani for documents on monday as they ramped up investigations of the presidents dealings with ukraine.

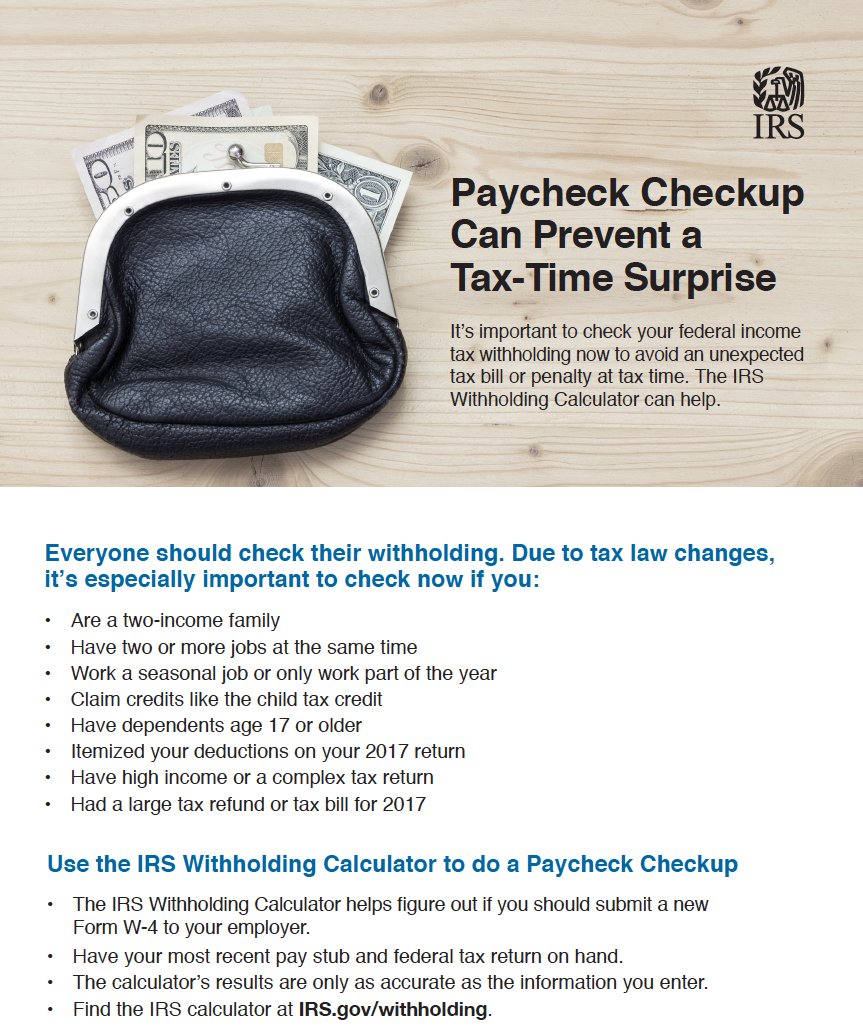

Irs payroll tax chairs.

Sign up for our mobile text alerts.

The irs has issued final regulations and three related pieces of guidance implementing the new qualified business income qbi deduction sec.

Want to receive important announcements exclusive discounts and chances to win prizes.

Discover more about us or subscribe to our popular newsletter below.

Our simple approach is to make sure all veterans have their va card i never leave home without mine and we want to make sure you have yours do you.

Its an exciting time that involves a roller coaster of emotions and activities.

New hire paperwork includes federal and state tax paperwork.

Were so glad to have you as a member.

Opening your own spa or beauty establishment means youre prepared to reach for the top.

Join us at one of our many events at one of our centers.

Professional Corporation Tax Advantages Legalzoom Legal Info

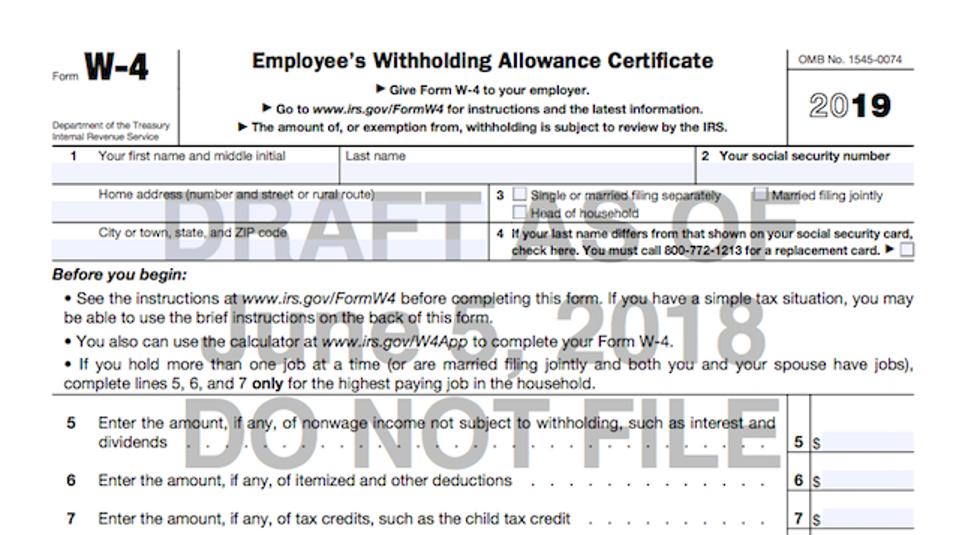

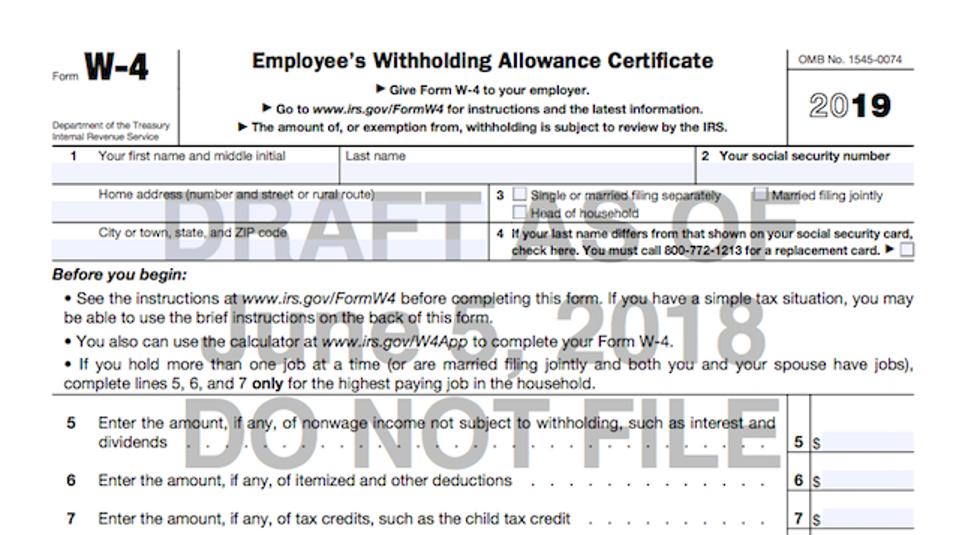

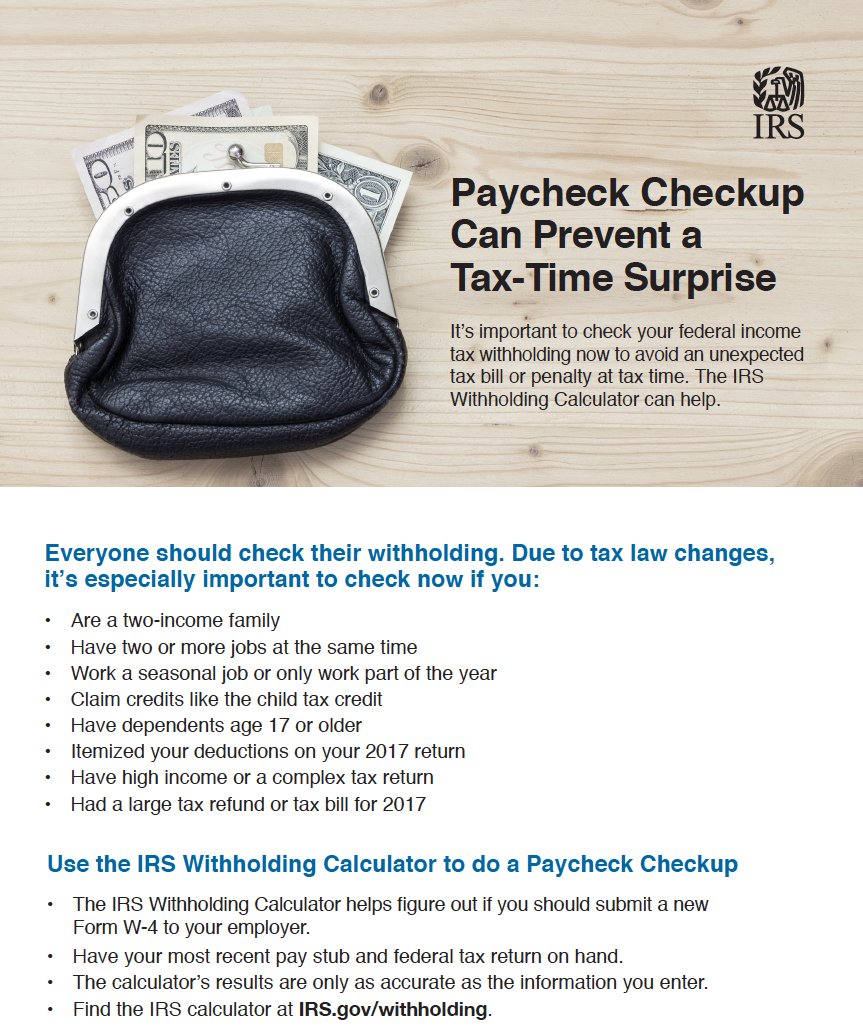

After Pushback Irs Will Hold Big Withholding Form Changes

House Ways And Means Chair Requests Trump S Tax Returns From

Employer Tax Forms For Employees Canada New 1111111

Are You A Telecommuter With A Home Office You Just Lost A

Aicpa Asks Treasury And Irs To Withdraw Proposed Estate Tax

Irs Revamps Form W 4 Taxing Subjects

:max_bytes(150000):strip_icc()/business_owner-970532960-5bc0bee4c9e77c005122cb13.jpg)

Setting Up Your Payroll Tax System Step By Step

How To Get An Ein Number For A Non Profit Organization

/man-working-at-home-968890648-2440a6e40b274fbaa6be16a9d4c3002b.jpg)

Self Employment Tax Definition

Should You File An Offer In Compromise On Payroll Taxes

Irs Releases New Draft Form W 4

Century Files State And Federal Taxes Months Late Amasses

The 1040 The Schedule C Part Ii Expenses Taxes Are Easy

Report Irs Draft Memo Says Trump Must Turn Over Tax Returns

Understanding How The Irs Classifies Your Group Exercise

Can An Employee Be Held Liable For Their Employer S Unpaid

Apa Members Serving On Irs Advisory Committees

What If I Can T Afford To Pay My Taxes

Employer Faces 5 Years Imprisonment For Not Paying

What You Need To Know About The Fmla Tax Credit Primepay

What Is The Minimum Monthly Payment For An Irs Installment

Irs Auctions Your Chance To Take Home The Gold

Figure Out Take Home Pay From New Irs Tables Consumer Reports

Using R D Credits To Reduce Payroll Taxes An Overlooked

New 2019 Form W 4 Released But Concerns Persist

Covington May Rethink Incentives For Developers To Offset

Irs Enrolled Agent Hansen Sweeney Accountants Canary

5 Tax Tips For The Self Employed The Motley Fool

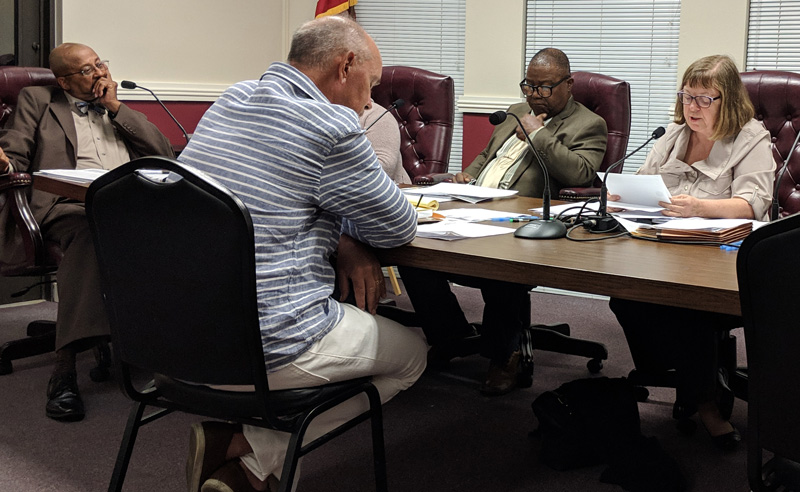

Irs Fines County For Payroll Tax Issues Livingston Enterprise

Hillhurst Tax Group Irs Tax Attorneys 22 Photos 34

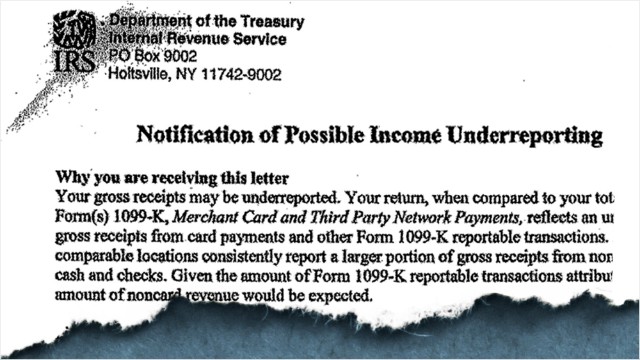

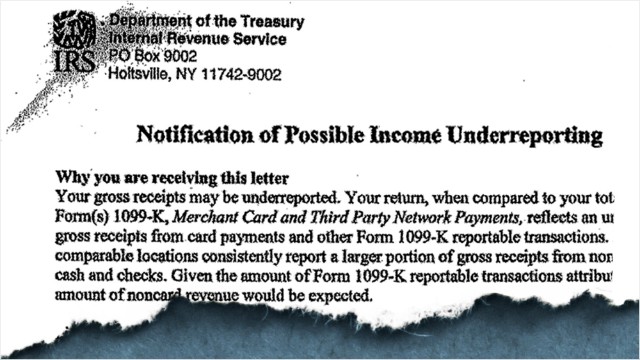

The Irs Is Cracking Down On Small Businesses

Don T Let Your Client Suffer The Consequences Of Not Paying

Your Guide To The 2018 Irs Tax Withhold Tables

Small Business Taxes Fastupfront Small Business Blog

Irs Cyber Thieves Stole Up To 39m

Work Remotely This Little Known Tax Provision Could Save

Beware The Latest Tax Refund Scam Tax Helpers

Confused About Irs Health Coverage Form 1095 C Consumer

How Do I File Back Tax Returns Turbotax Tax Tips Videos

The Ultimate List Of Small Business Tax Deductions

Stung By The Irs On Your 2018 Taxes Consumer Reports

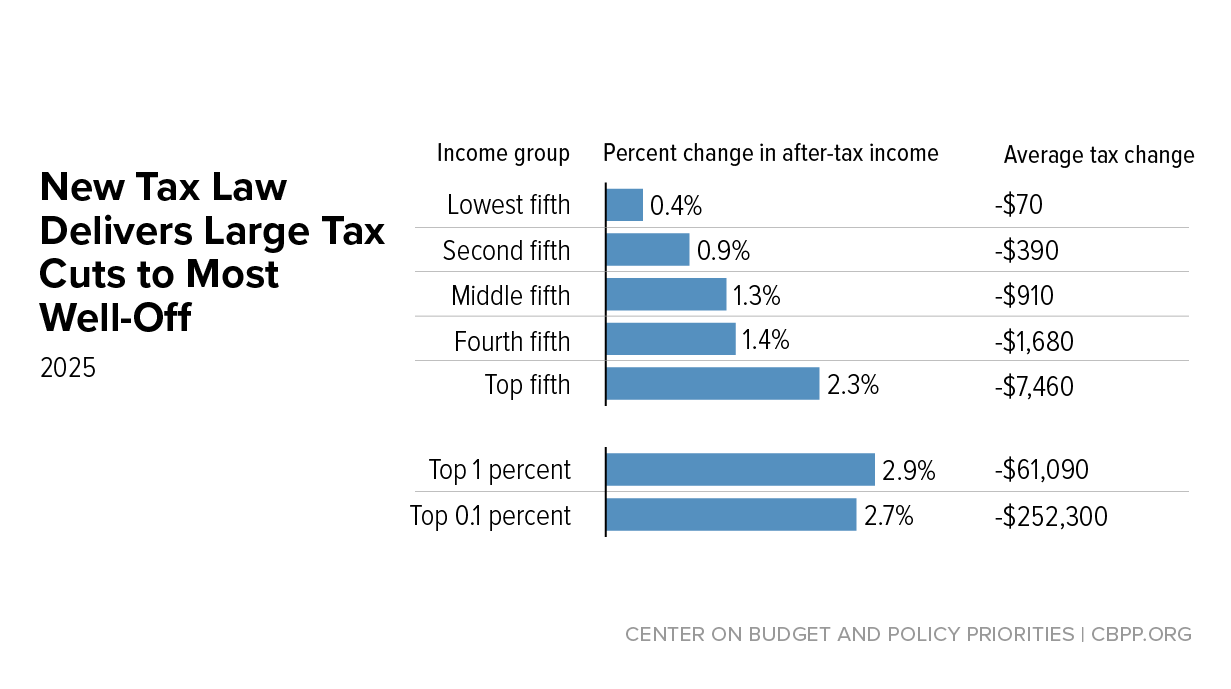

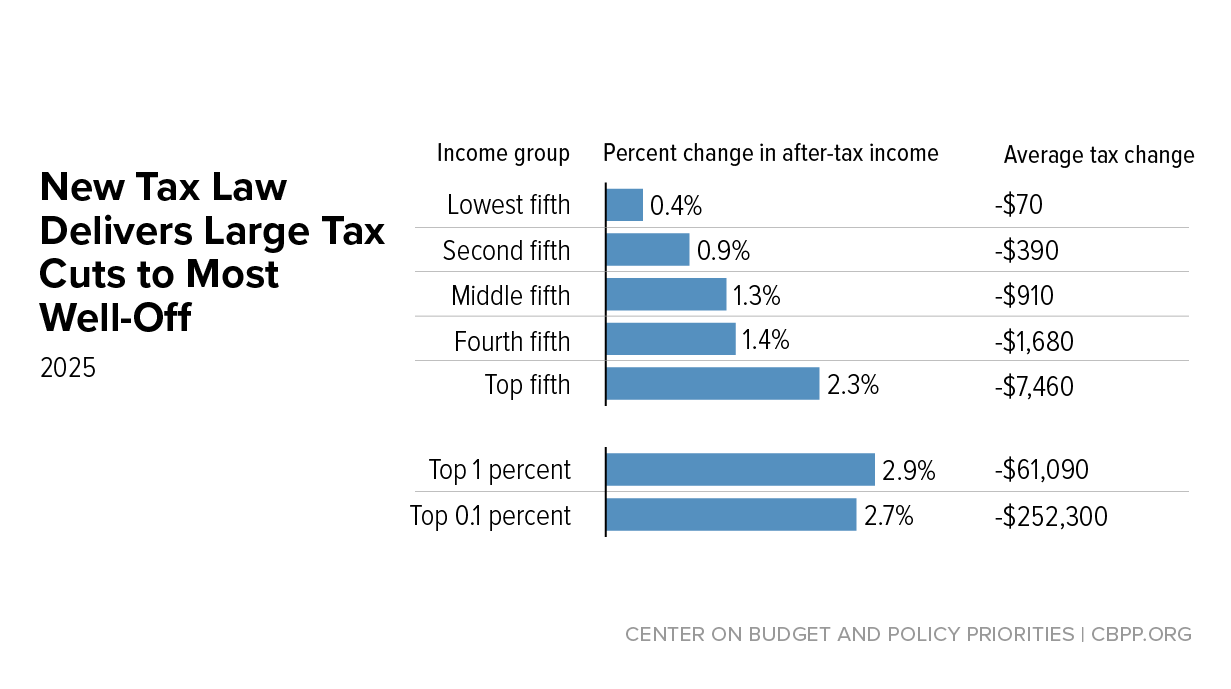

New Tax Law Is Fundamentally Flawed And Will Require Basic

Irs Allows Employers To Recover Mistaken Hsa Contributions

/she-handles-the-bills-in-this-home-638771304-5a7fe3f0eb97de0037293c18.jpg)

Paying Taxes On Cd Interest Maturity Or Withdrawals

Employer Tax Forms For Employees Canada New Procedure

Rich People Are Getting Away With Not Paying Their Taxes

Will A Bonus Make You Pay Higher Federal Taxes

Seven Things You Didn T Know About Taxes Turbotax Tax Tips

When Did I Last File My Taxes

Household Employee Taxes Do I Owe Nanny Tax Even For Non

Can The Irs Garnish My 1099 Earnings Tax Problem Solver

California Payroll Tax Audits And Defending Independent

Immigrants Working Illegally In The U S File Tax Returns

Lsbdc On Twitter Entrepreneurs And Smallbiz Owners

Hobby Or Business Virginia Beach Tax Preparation

How Does The Government Shutdown Affect Tax Returns

Important Information Regarding Your 2018 Tax Return Jem

When The Nanny Tax Applies To A Babysitter Care Com

Do You Owe Payroll Taxes To The Irs Or Edd Workshops For

Know Your Tax Dates Irs Forms With Our Calendar Sage

Serve On Nonprofit Board Face Tax Liability

Cpa In Scottsdale Az P Curtis Black Cpa

Irs Dropped 8 Million Calls During Tax Filing Season Pbs

Cata Board Discusses Payroll Tax Error

Understanding An Irs Installment Agreement

State Income Tax Wikipedia

1099 Vs W 2 How Independent Contractors And Employees

Irs Seeks Comments On Form W 4 Overhaul For 2020 Clearpath

Institutional Terrorism Systemic Irs Abuse Designed To

Irs Releases 2018 Form W 4 Updates Withholding Calculator

/cdn.vox-cdn.com/uploads/chorus_image/image/58409839/897291366.jpg.0.jpg)

Government Shutdown 2018 How Tax Returns And Refunds Are

Irs Provides Tax Filing Relief For Hurricane Irma Victims

The Us Tax Man Speaks For The First But Not Last Time

Futa What Is The Federal Unemployment Tax Act

940 Payroll Tax Archives Paywow

August 2018 Payroll Channel

Employers Be Aware Or Beware Of A Harsh Payroll Tax

Irs The Dancing Accountant

How The Irs 2019 Form W 4 Will Change Payroll

Unpaid Payroll Taxes A Hidden Liability For Churches And

/GettyImages-8404356101-5a464356980207003715f606.jpg)

Job Search Tax Deduction Elimination For 2018 And Beyond

/minority-interest-income-statement-5954ad873df78cdc29246f3d.jpg)

Timing Business Income And Expenses At Tax Year End

Surviving A Salon Or Spa Irs Audit Cash Really Counts

Serve On Nonprofit Board Face Tax Liability

Do I Have To Pay The Nanny Tax And What Is It

Irs Audit Group 29 Photos 27 Reviews Tax Law 468 N

The Gig Economy And Taxes Basics Beyond

New Tax Law Is Fundamentally Flawed And Will Require Basic

Century Files State And Federal Taxes Months Late Amasses

:max_bytes(150000):strip_icc()/HeroImagesGettyImages-65a9475bbae746848eee99e8fff09f2d.jpg)

15 Tax Deductions And Benefits For The Self Employed

Tax Refunds Issued So Far Are Smaller Than Last Year Irs

2019 Irs Form 944 Simple Instructions Pdf Download

5 Irs Penalties You Want To Avoid Turbotax Tax Tips Videos

Irs And State Audit Representation Las Vegas Cpa Professionals

Futa What Is The Federal Unemployment Tax Act

Irs Seeking Feedback On Proposed Form W 4 Primepay

Coeur D Alene Idaho Accountant Cpa And Tax Services

:max_bytes(150000):strip_icc()/business_owner-970532960-5bc0bee4c9e77c005122cb13.jpg)

/man-working-at-home-968890648-2440a6e40b274fbaa6be16a9d4c3002b.jpg)

/she-handles-the-bills-in-this-home-638771304-5a7fe3f0eb97de0037293c18.jpg)

/cdn.vox-cdn.com/uploads/chorus_image/image/58409839/897291366.jpg.0.jpg)

/GettyImages-8404356101-5a464356980207003715f606.jpg)

/minority-interest-income-statement-5954ad873df78cdc29246f3d.jpg)

:max_bytes(150000):strip_icc()/HeroImagesGettyImages-65a9475bbae746848eee99e8fff09f2d.jpg)