Taxation Section

:max_bytes(150000):strip_icc()/HeroImagesGettyImages-65a9475bbae746848eee99e8fff09f2d.jpg)

15 Tax Deductions And Benefits For The Self Employed

The Top 0 5 Underpay 50 Billion A Year In Taxes And

15 Facts About The Irs To File Away Mental Floss

Irs Hobby Income Get It Deducted As A Business If It Qualifies

Will A Bonus Make You Pay Higher Federal Taxes

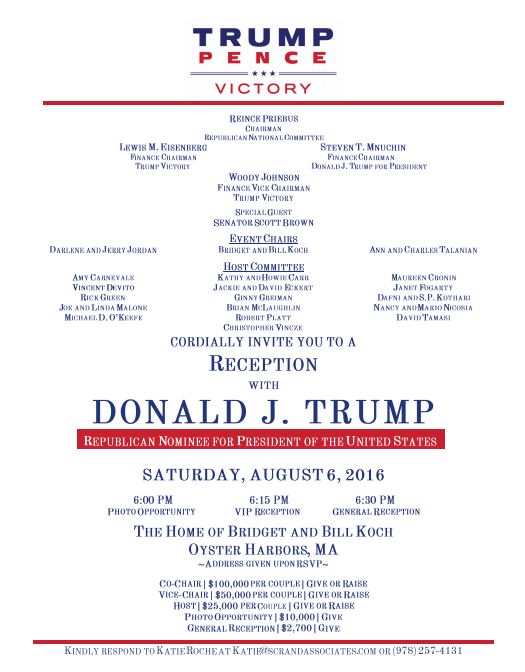

Key Democrat Requests Trump S Tax Returns From Irs

Irs Red Flags That Put Your Tax Return At Risk For An Audit

/still-life-of-chairs-in-big-stylish-conferenceroom-481489779-576864053df78ca6e41cf903.jpg)

Capital Expenses And Your Business Taxes

/u-s-tax-filing-1090495926-e2d35df4094146a587089d7b3158e64c.jpg)

Types Of Income The Irs Can T Touch

/smiling-businesswoman-in-discussion-with-clients-at-office-workstation-1097995910-840608b2994d4755a82ae3a234e4ed90.jpg)

How Forex Trades Are Taxed

Internal Revenue Service 10 Photos 33 Reviews Public

Irs Ignored Fake Tax Id Numbers Potentially Costing

Internal Revenue Bulletin 2014 16 Internal Revenue Service

How Are Social Security Benefits Taxed Charles Schwab

10 Surprising Items Irs Says To Report On Your Taxes

Confused About Irs Health Coverage Form 1095 C Consumer

State Income Tax Wikipedia

Irs You Owe Us An Additional 26 777 Me I Respectfully

4 Steps If You Haven T Filed Your Taxes In A While Inc Com

What Is The Life Of An Irs Officer Like Compared To An Ias

Untitled

Recent Developments In Individual Taxation

No Quick Answers For Virginia Tax Filers As State Senate

Irs Fixes Error In Schedule D Worksheet Taxing Subjects

A Tax Audit A Coverup And A Neighbor In The Oval Office

Are Negligence Settlements Taxable Finance Zacks

Richard Neal Key House Democratic Chairman Requests

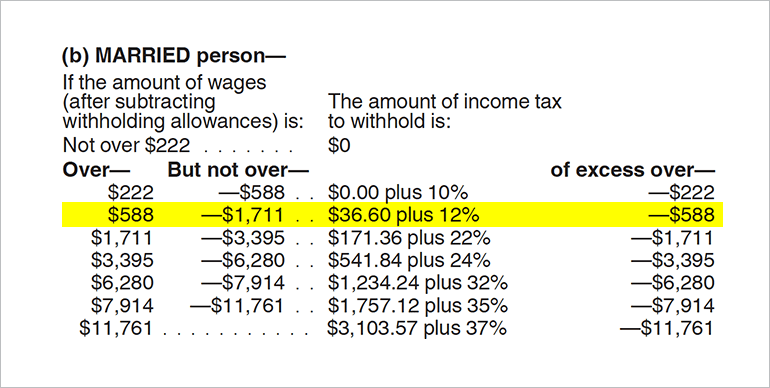

Figure Out Take Home Pay From New Irs Tables Consumer Reports

This Is Why Earnings From Survey Sites Count Toward Taxable

Non Profit Incorporation And Tax Exemption Workshop

/169997690-F-56a938735f9b58b7d0f95c6d.jpg)

How To Calculate Tax Balance Due On Form 1040

Aicpa Submits Comments To Irs On Corporate Estimated Tax

/minority-interest-income-statement-5954ad873df78cdc29246f3d.jpg)

Timing Business Income And Expenses At Tax Year End

Irs Continues To Urge Taxpayers To Doublecheck Their

How Much Will Charity Help Your Tax Bill Csmonitor Com

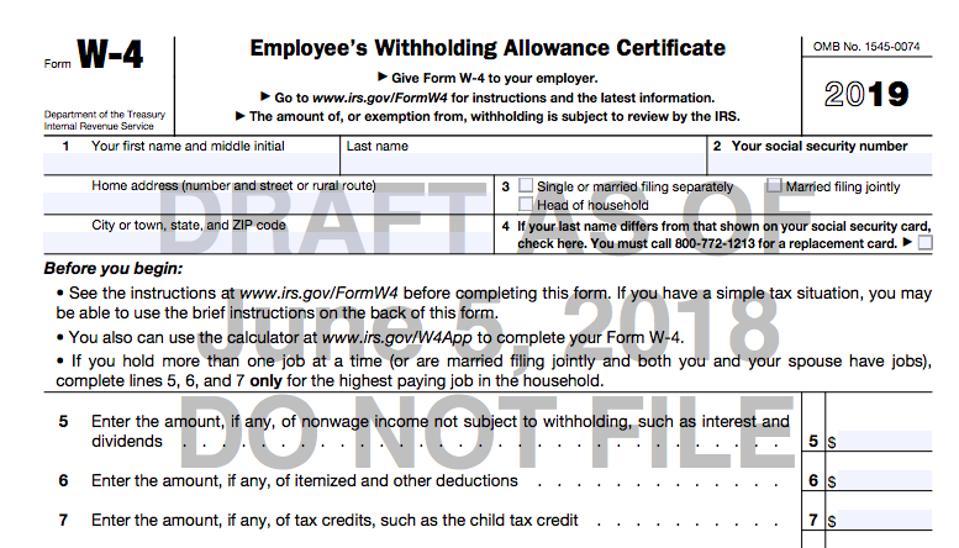

Federal Income Tax Individuals Syllabus Acnt 1331 Doc

How To Get Furniture Appraised For Tax Write Offs Finance

5 Irs Penalties You Want To Avoid Turbotax Tax Tips Videos

I Ve Been A Family Farmer For 30 Years Here S My Irs

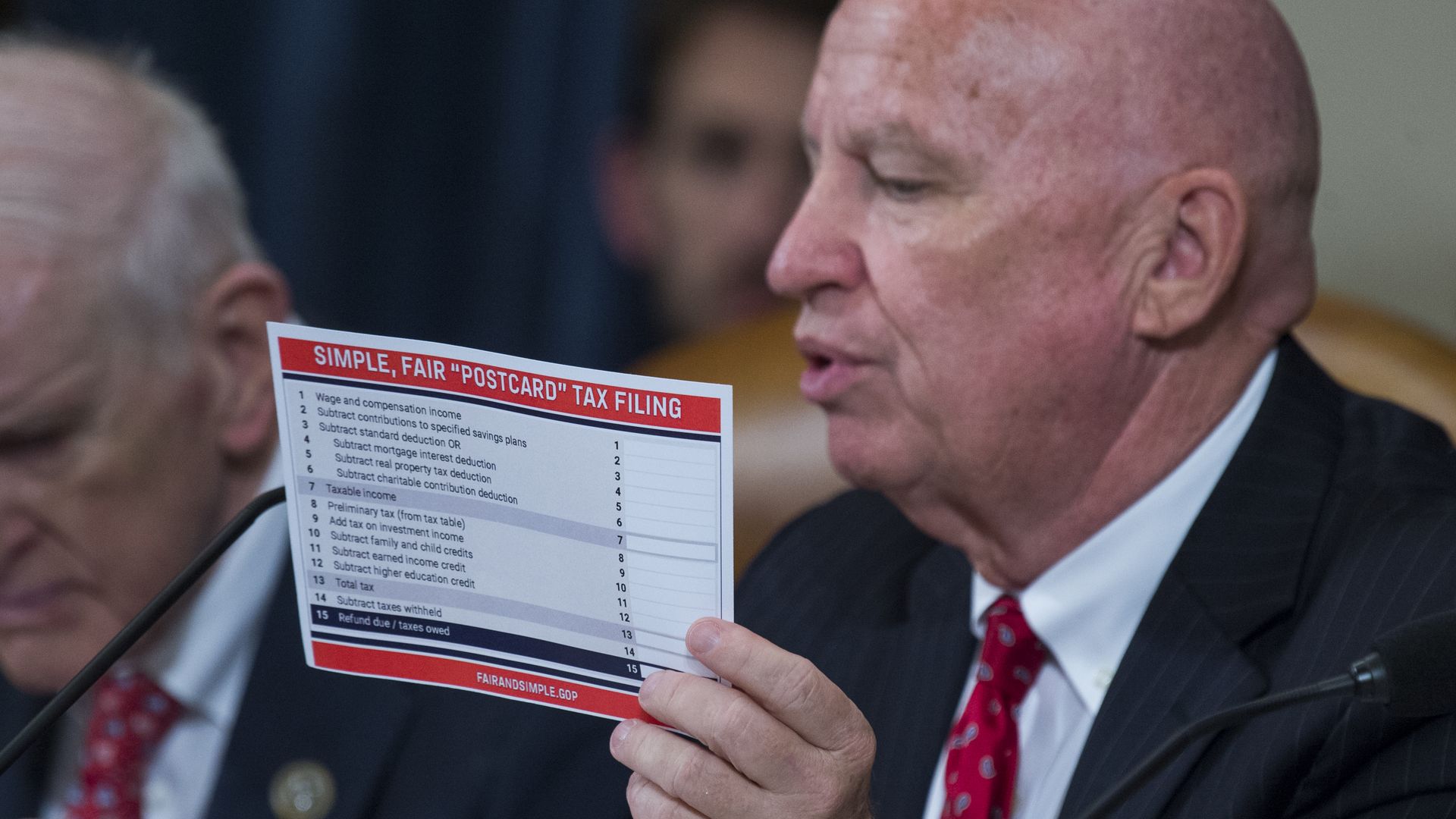

Irs Set To Release New Postcard Style Tax Forms Axios

Ssa Advisory 2016 01 Statewide Election Worker Ss And Mc

Understanding The New Kiddie Tax Journal Of Accountancy

Understanding The New Kiddie Tax Journal Of Accountancy

How To Correct Irs State Tax Return Rejections On Efile Com

Charles Rettig Wikipedia

Tfx 5471 Guide

Please Complete Form 1040 Schedule D Form 4797 1

Is Social Security Taxable The Motley Fool

Opinion New York Can Tell Congress Lots About Trump S

Not A Us Person But Receiving Social Security Benefits You

Irs Home Office Tax Deduction Rules Calculator

You Got A Cp2000 Notice From The Irs Now What

/GettyImages-540204814-5766e4423df78ca6e4d8ca6c.jpg)

Reporting Capital Gains And Losses To The Irs Form 8949

/she-handles-the-bills-in-this-home-638771304-5a7fe3f0eb97de0037293c18.jpg)

Paying Taxes On Cd Interest Maturity Or Withdrawals

The Ultimate List Of Small Business Tax Deductions

What Is A Tax Deduction Daveramsey Com

How To Calculate Profit Gross Income And Taxable Income

The Irs Tried To Take On The Ultrawealthy It Didn T Go Well

/450824025-F-56a938665f9b58b7d0f95be1.jpg)

The Rules For Deducting Business Expenses On Federal Taxes

New York City Bar 44th Street Notes Week Of June 3 2019

Get Help On Your Taxes Without Calling The Irs Consumer

/486989097-56a938ab3df78cf772a4e54c.jpg)

2019 Tax Tips For Capital Gains And Losses

California Tax Board N98 5 Internal Revenue Service

The Most Overlooked Tax Deductions

Figure Out Take Home Pay From New Irs Tables Consumer Reports

Flipping Houses Taxes Capital Gains Vs Ordinary Income 2019

Is That Side Hustle A Business Or A Hobby Know The

Is My State Tax Refund Taxable And Why The Turbotax Blog

Individual Taxation Fall 2011 Syllabus Doc

Irs Answers Wisconsin Readers Questions About Changes In

/GettyImages-8404356101-5a464356980207003715f606.jpg)

Job Search Tax Deduction Elimination For 2018 And Beyond

House Committee Deploys Century Old Tax Code Provision To

Irs Tax Help For Pastors Money Wise Pastor

To The Honorable Sylvia Luke Chair And Members Of The

Irs You Owe Us An Additional 26 777 Me I Respectfully

6 Things That Side Gig Will Probably Do To Your Taxes

Stung By The Irs On Your 2018 Taxes Consumer Reports

How The Irs Knows You Didn T Report Income Cbs News

What Is The Minimum Monthly Payment For An Irs Installment

File Your Taxes Before Scammers Do It For You Krebs On

20 Qualified Business Income Deduction H R Block Newsroom

Rich People Are Getting Away With Not Paying Their Taxes

Steven Mnuchin Makes A Welcome Case For Boosting Irs Funding

How The Irs Was Gutted

Taxpayers Who Filed Tax Returns In U S Virgin Islands Enjoy

Irs Tax Filing Rules Offer Eitc To Those With Disabilities

/GettyImages-530054733-5686c1185f9b586a9e35a303.jpg)

Tax Filing For Home Based Businesses

/cdn.vox-cdn.com/uploads/chorus_image/image/62864694/897291366.jpg.0.jpg)

Government Shutdown 2019 How Tax Refunds And Returns Will

Do You Need An Ein Internal Revenue Service

/GettyImages-550437755-56a636ec5f9b58b7d0e06e89.jpg)

Earned Income Is Taxed Differently Than Unearned Income

Tax Deductions For Jury Duty Pay And Expenses Turbotax Tax

California Tax Board Ln99 9 Internal Revenue Service 11

199a Regulations Irs 199a Allows 20 Qbi Deductions In

White House Orders Irs To Pay Income Tax Refunds Despite

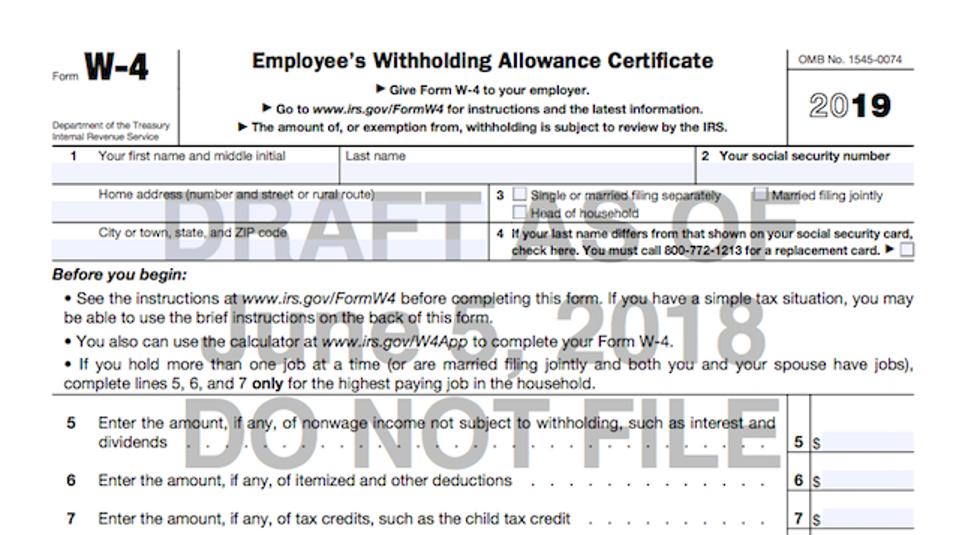

After Pushback Irs Will Hold Big Withholding Form Changes

The New Irs Tax Forms Are Out Here S What You Should Know

Can The Irs Garnish My 1099 Earnings Tax Problem Solver