Deppro depreciation professionals property report investment property calculator investing in property tax depreciation property depreciation melbourne.

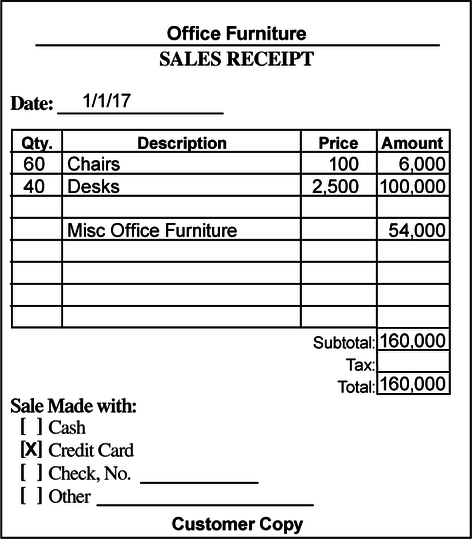

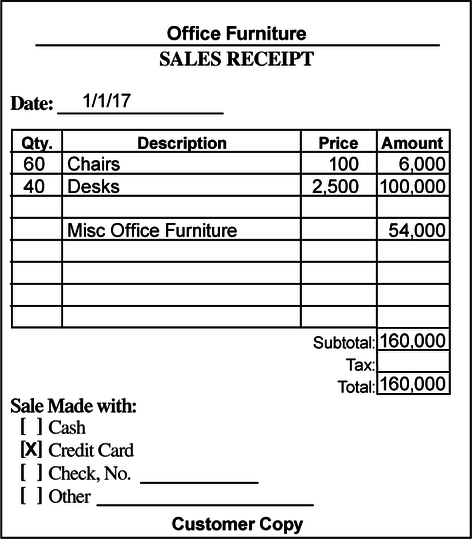

Tax depreciation chairs.

Personal property tax in idaho is assessed by the county assessors office of the county where its located.

Independent contractors who are sole proprietors report taxes on form 1040 and schedule c.

Whats deductible whats not for property investors.

A 25 percent tax rate applies to the amount of gain that is related to depreciation deductions that were claimed or could have been claimed on a property.

All business concerns corporations partnerships and professionals are required by oklahoma statutes to file each year a statement of taxable assets as of january.

Independent contractor taxes include federal income tax self employment tax state and municipal taxes.

Taxes are due on april 15 or october 15 if filed on extension.

This page doesnt cover information on personal property owned by operating property companies such as public utilities and railroads which is assessed by the idaho state tax commission.

Applications for the 2018 tax year payable 2019 will be accepted january 1 2018 to april 1 2019.

Form 901 instructions who must file.

Real property that has been depreciated is subject to a special depreciation recapture tax.

Below is a list of items which you can claimed as a deduction against rental income for this year.

Section 179 is a type of tax deduction that lets you deduct up to 1 million in equipment and other fixed assets as a business expense on your tax return.

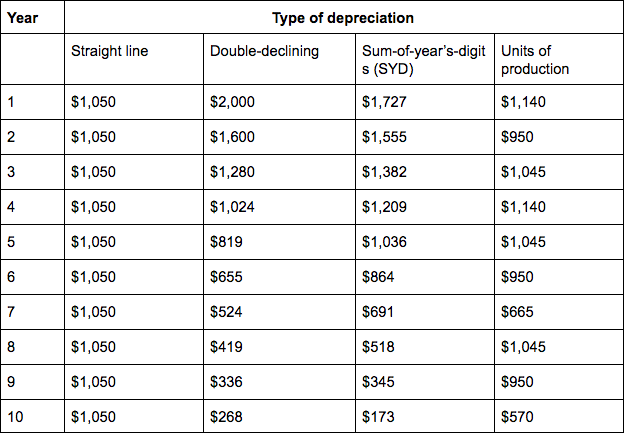

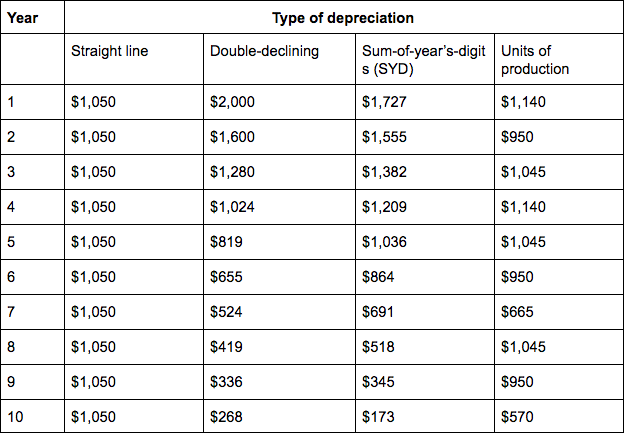

Furniture depreciation requires three pieces of information to calculate the annual expense associated with this accounting process.

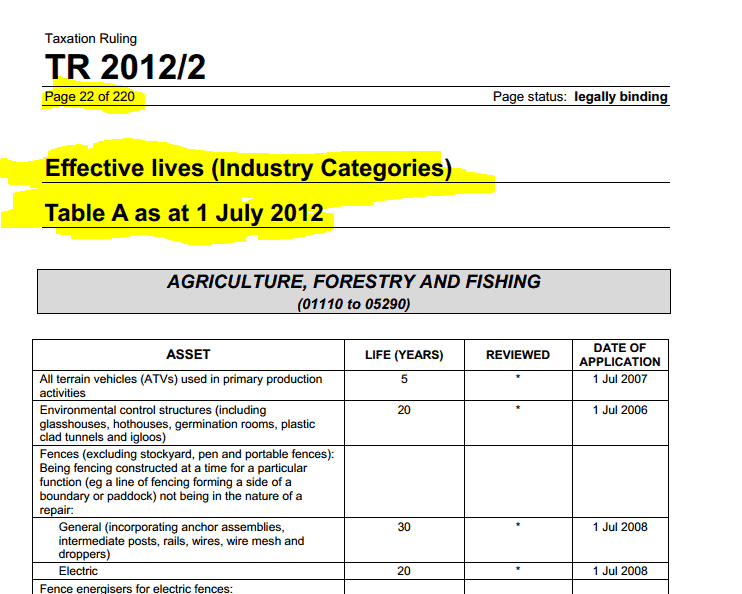

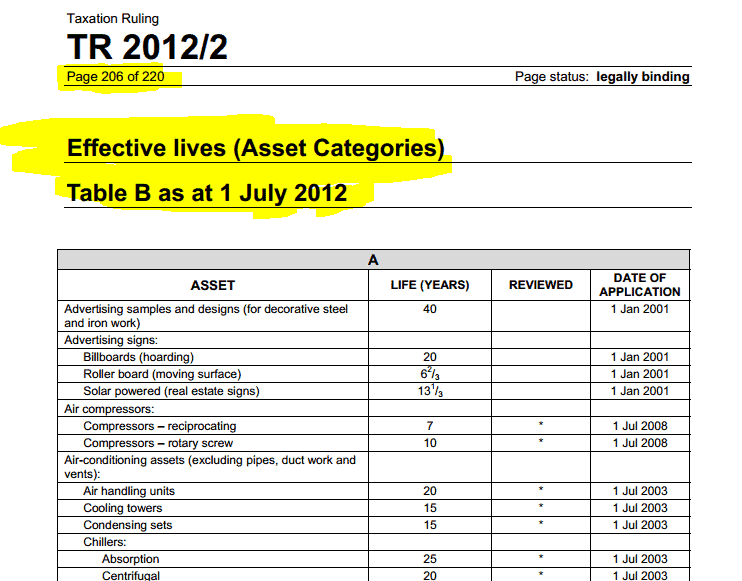

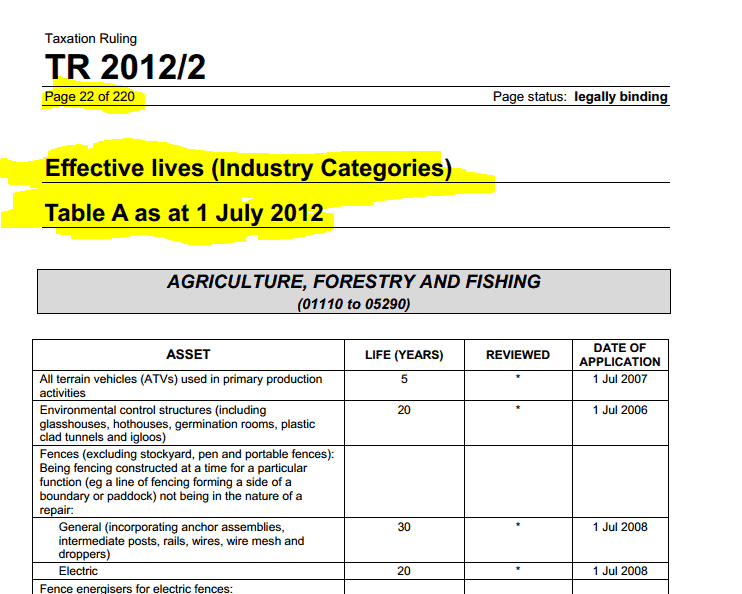

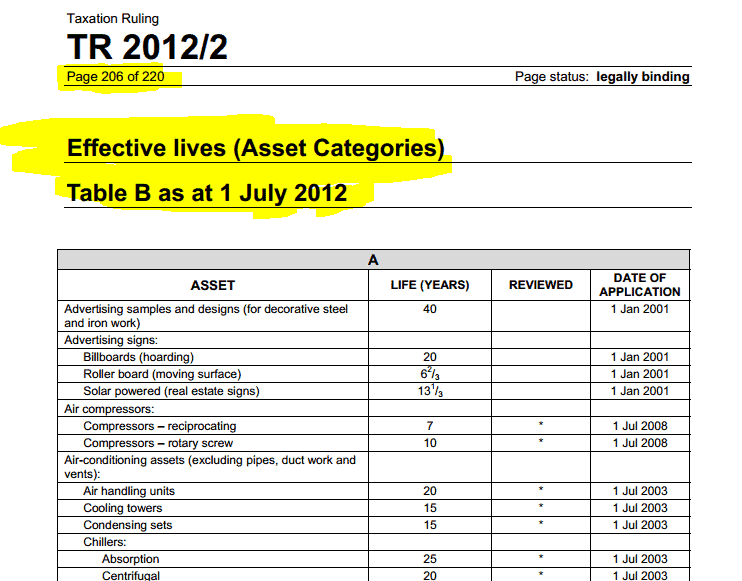

Tax Depreciation Used For Quantity Surveyor In Australia

Home Office Ba Tax Depreciation Schedules Depreciation

For Many Taxpayers Tax Reform Means No More Home Office

The Ultimate List Of Small Business Tax Deductions

The Depreciation Rules May Change But The Goal Is The Same

Depreciation Nbaa National Business Aviation Association

Small Businesses Can Save Big With Section 179 No Tariffs

Building Depreciation Rate Archives Tax Jankari

Claiming Funds From Depreciating Furniture Innovatus Group

Furniture Fixtures And Equipment Depreciation Calculation

Home Business Tax Depreciation A Quick Guide Fryday

Prime Cost Straight Line And Diminishing Value Methods

Furniture Fixtures And Equipment Depreciation Calculation

16 Best Conferences For Property Tax Professionals

Tax Depreciation Schedule Archi Qs Australia

Undeveloped Software Taxation Tax Alert Deloitte New Zealand

Tax Savings Rental Property Depreciation Explained Fox

Freelancer S Tax Computation Expenses Total Taxable Income

Business Tax Tips Home Office Expenses The Ato Allows You

Depreciation Of Business Assets Turbotax Tax Tips Videos

Depreciation Deductions Rules Markham Norton Mosteller

How 2018 Tax Reforms Affect Buying Office Furniture

Tax Savings Salon Spa Equipment Salon Equipment Usa

Day Care Depreciation Lovetoknow

55 Tax Practitioners Board Tpb What Does The Tpb Do And

Tax Resources Horne

New Home Office Expenses Option Generate Accounting

Tax Depreciation Used For Quantity Surveyor In Australia

/businessman-falling-down-a-profit-and-loss-chart-738785337-5a309b61b39d030037a81560.jpg)

How To Take A Depreciation Deduction On Your Tax Return

How Hoteliers Can Take Advantage Of The 2018 Tax Reform Bill

Video Archives Page 2 Of 2 Koste Tax Depreciation

Are You Missing Out On Tax Depreciation Claims Tax

How To Depreciate Furniture Chron Com

/architects-working-at-computers-in-open-plan-office-686721451-5a8eeca50e23d9003707680d.jpg)

Difference Between Depreciation And Amortization

Engineering Economics Lecture 8 Pdf Depreciation Expense

The Tax Benefits For A Musician Chron Com

Government Caps Depreciation Rate To Raise Companies Tax

Home Office Deductions For Diy Landlords Avail

Where Do I Report Expenses Below 2 500 On My Tax Return

Tuesday Tax Tidbit Maximizing Depreciation Deductions In An

The Eventual And Often Unexpected Tax Cost Of Home Office

Home Office Deduction Houselogic

4 Ways To Depreciate Equipment Wikihow

How Do I Calculate Computer Depreciation With Pictures

Solved Joseph Purchased The Assets Located In The Exhibit

10 Questions Airbnb Hosts Ask About Taxes On Rental Income

The Real Impact Of The Property Depreciation Changes Money

20 000 Accelerated Depreciation Of New Assets Regional

Receive A Tax Deduction While Supporting Canadian Artists

Luxury Car Tax And How It Works

1 Lecture 1 Introduction To Module 2 Module 2 Module 2

/still-life-of-chairs-in-big-stylish-conferenceroom-481489779-576864053df78ca6e41cf903.jpg)

Capital Expenses And Your Business Taxes

Ato Depreciation Rates Atotaxrates Info

Depreciation Related Breaks 2016 Tax Savings On Business

10 Easily Overlooked Tax Deductions Vacation Rental Hosts

Home Office Expenses Are You Missing Out On Tax Deductions

Home Office Tax Writeoffs Can Save You Money Cbc News

The Magic Of Depreciation For Investors Tax Depreciation

Tax Accountant Wondering Ancient Printers Can Stock

Asset Reports Property Condition Reports

4 Ways To Depreciate Equipment Wikihow

An End To Unnecessary Secondary Tax Ird News

How Much Of A Tax Deduction Do I Get From Donating Furniture

Helpful Tips Beyond Tax

Ato Depreciation Rates Atotaxrates Info

How To Use The Quickbooks Fixed Asset Tool Muir Associates

Houseboat Depreciation 13 Tips Examples With Pictures

Going Up Or Down Your Taxes Will Likely Change Under

Increase Your Return Tax Depreciation Schedule

Irs On Twitter An Irssmallbiz Tip New Tax Laws Regarding

How To Claim A Home Office Finder Com Au

What S More Important Than Landlords Insurance Asset Agents

Income Taxes Problem A Problem A Solution Alamo Inc Had

The Ultimate List Of Small Business Tax Deductions

Should I Buy An Investment Property With A Pool

/GettyImages-200171399-001-576046993df78c98dc329c33.jpg)

Tax Consequences For Home Business Offices

Calculating Depreciation How It S Done Ionos

Moving Back Into A Rental Property To Save On Capital Gains Tax

Tax Depreciation Bmt Tax Depreciation

Numerous Tax Incentives Available To Hotel Owners Energy

What Is Depreciation And How Do You Calculate It Bench

Organize Bookkeeping Records For Small Business Owners

Tax Depreciation Bmt Tax Depreciation

Irs Home Office Tax Deduction Rules Calculator

Everything You Need To Know About Holiday Rentals

100 Tax Depreciation

Claiming Capital Allowance And Depreciation On Renovations

Devil S Detail Interior Glass Depreciation Glassonweb Com

Simplified Depreciation Fine Furniture Design Fine Art

Hobby Or Business Virginia Beach Tax Preparation

Tax Litigation Firm In Trinidad Tobago

Depreciation Under Federal Income Tax Depreciation Rules Pdf

Depreciation Nonprofit Accounting Basics

It S A Good Time To Buy Business Equipment And Other

Depreciation Rate For Furniture Plant Machinery

The Ultimate List Of Tax Deductions For Shop Owners In 2019

Depreciation Schedules 438 Gst Get Your Report Online

The Categories Of Depreciation Tom Copeland S Taking Care

/businessman-falling-down-a-profit-and-loss-chart-738785337-5a309b61b39d030037a81560.jpg)

/architects-working-at-computers-in-open-plan-office-686721451-5a8eeca50e23d9003707680d.jpg)

/still-life-of-chairs-in-big-stylish-conferenceroom-481489779-576864053df78ca6e41cf903.jpg)

/GettyImages-200171399-001-576046993df78c98dc329c33.jpg)