As a life insurance policy it represents a.

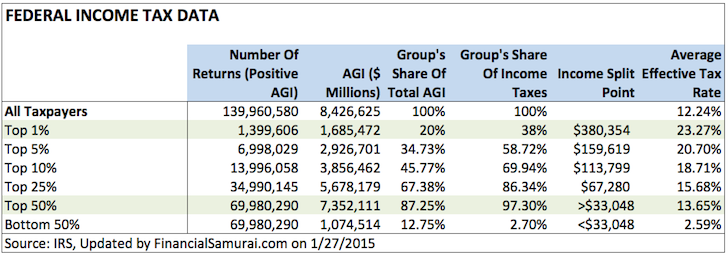

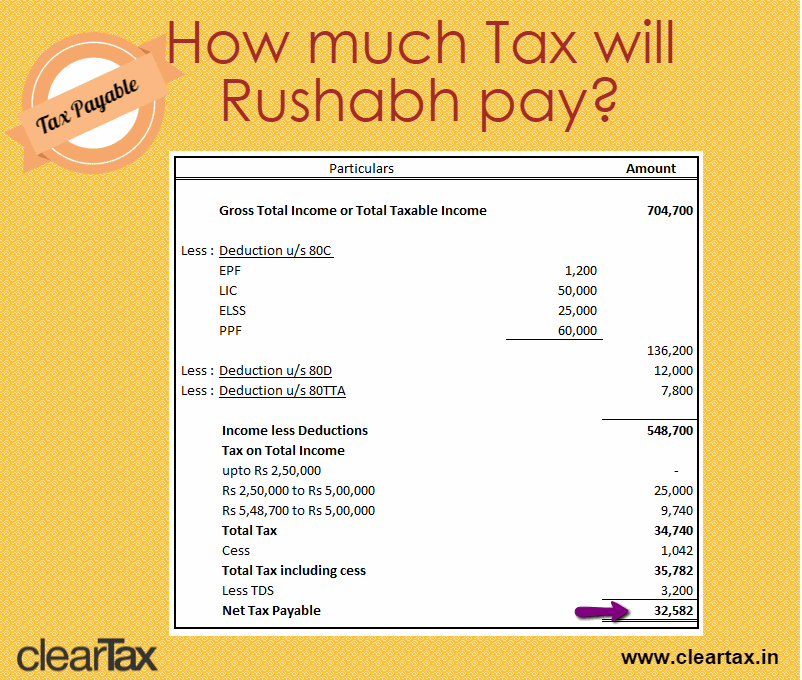

Taxable income chair 2015.

The previous law required the kiddie tax to be the greater of two tax calculations.

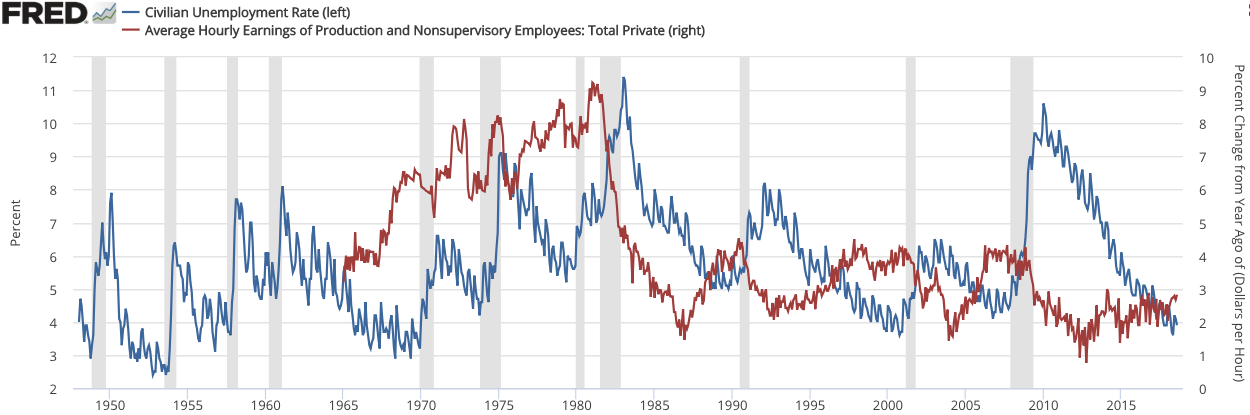

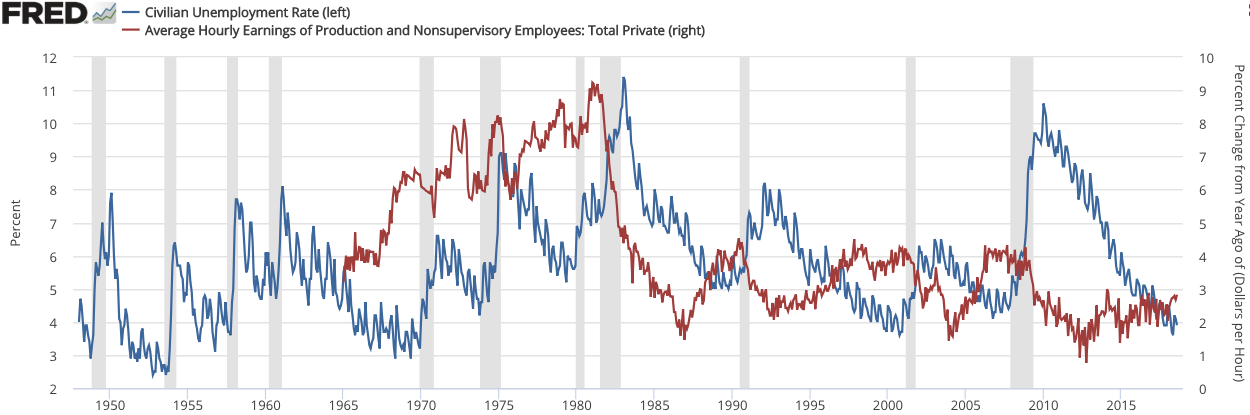

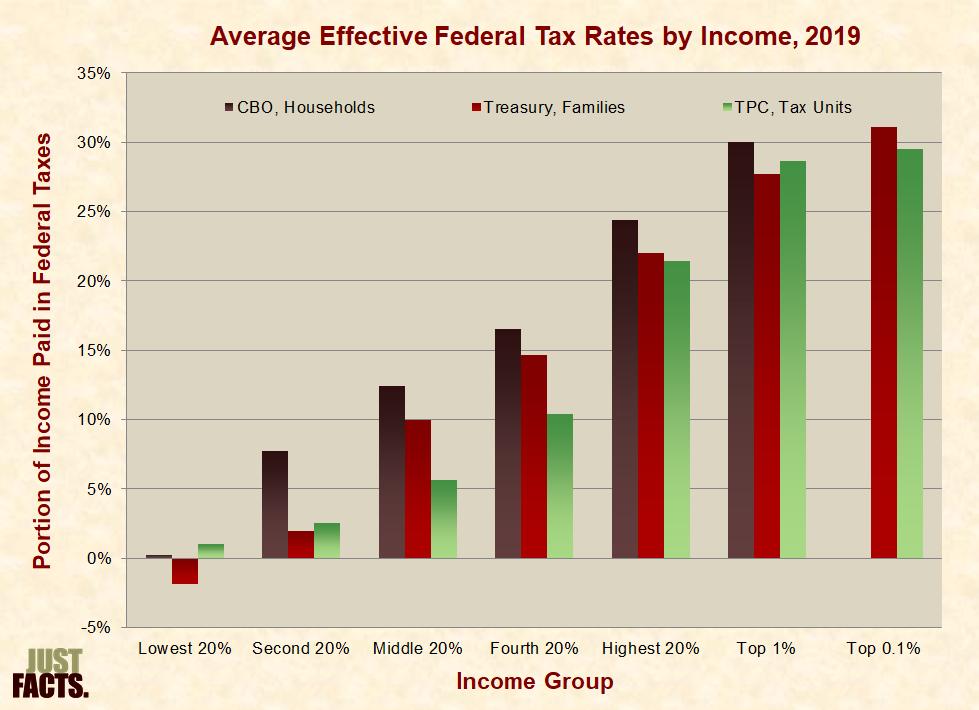

Learn about the measures sources correlates and trends of economic wellbeing in the us.

Whole life insurance or whole of life assurance in the commonwealth of nations sometimes called straight life or ordinary life is a life insurance policy which is guaranteed to remain in force for the insureds entire lifetime provided required premiums are paid or to the maturity date.

References in these instructions are to the internal revenue code irc as of.

And across the world.

In order to deduct certain moving expenses you must be an active member of the military and moving due to a permanent change of duty station.

The aicpa advocated for a simpler kiddie tax as congress crafted the tcja.

California s corporation franchise or income tax return.

Stock news by marketwatch.

Leg complete leggett platt inc.

This advocacy was at least partially successful since some of the complexities in the old kiddie tax are no longer present in the new law.

View real time stock prices and stock quotes for a full financial overview.

For tax years 2018 through 2025 the deduction of certain moving expenses is suspended for nonmilitary taxpayers.

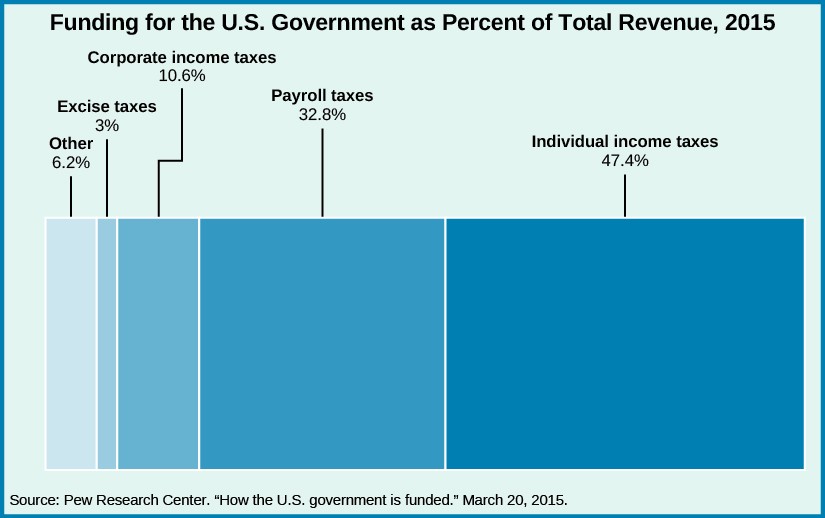

United States Federal Budget Wikipedia

Taxation In Six Concepts A Student S Guide Anne Alstott

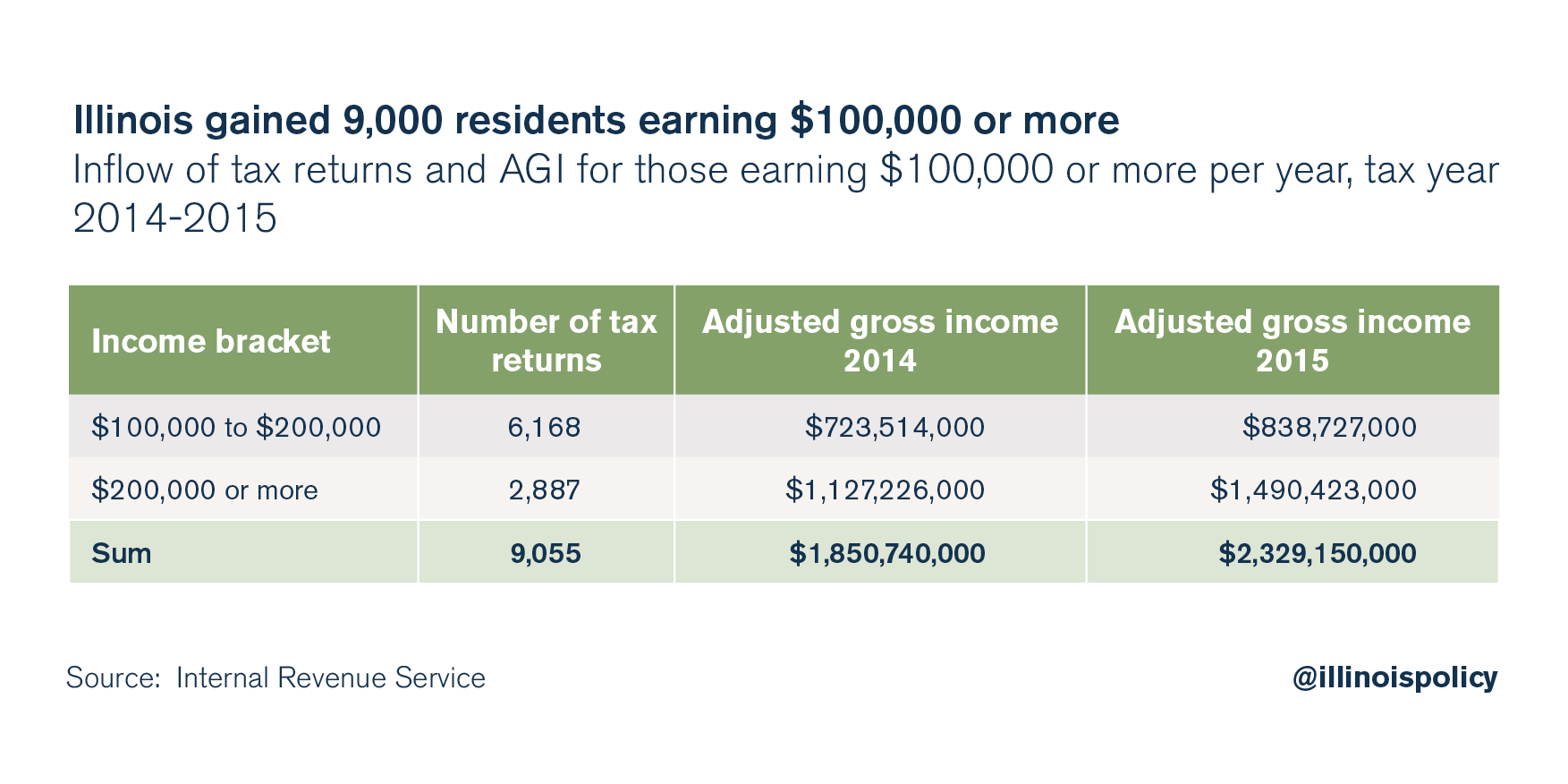

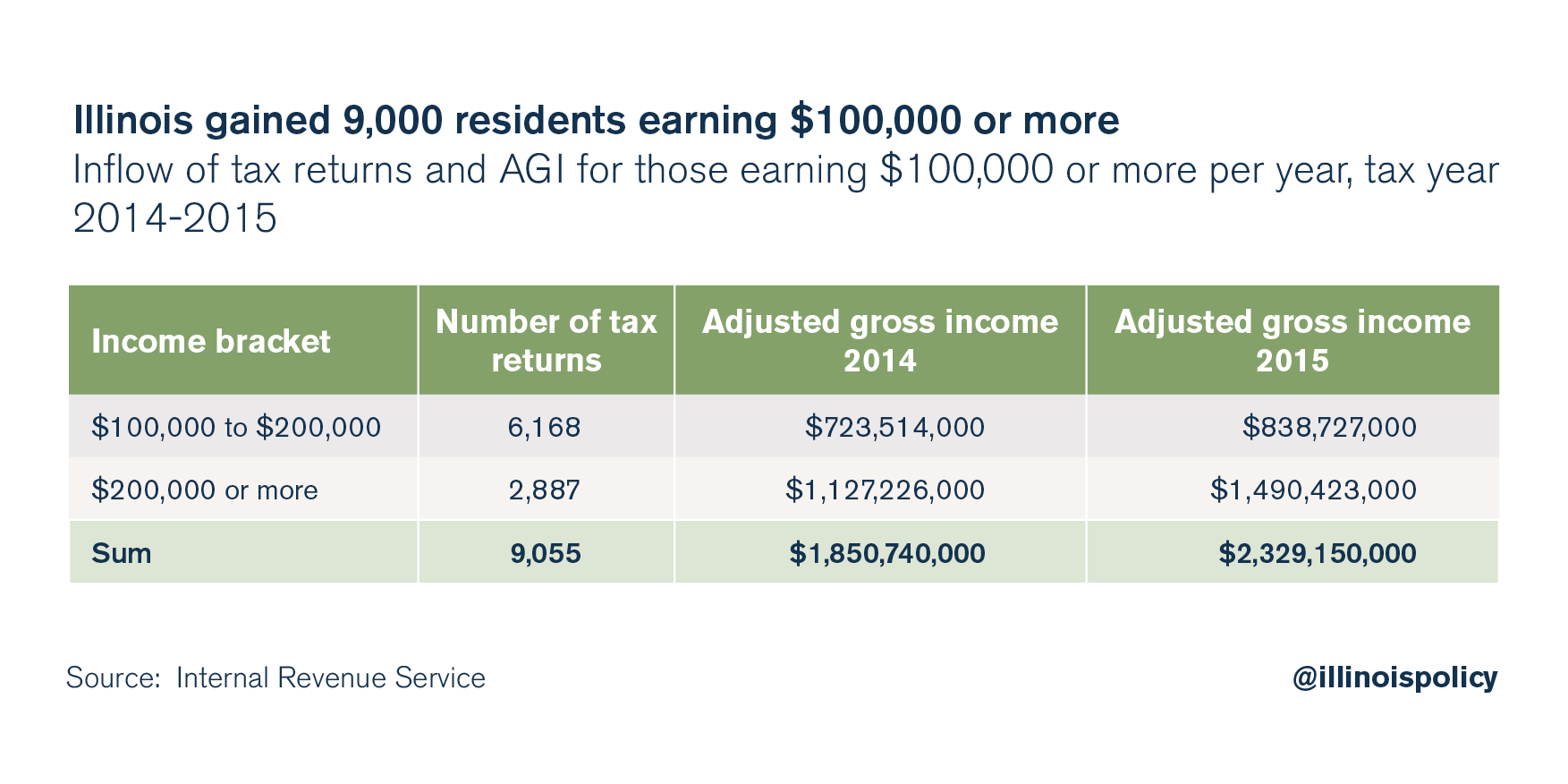

Illinois Is Losing Its Core Income Tax Base

Pro Tech Systems Inc Purchased The Following Equ

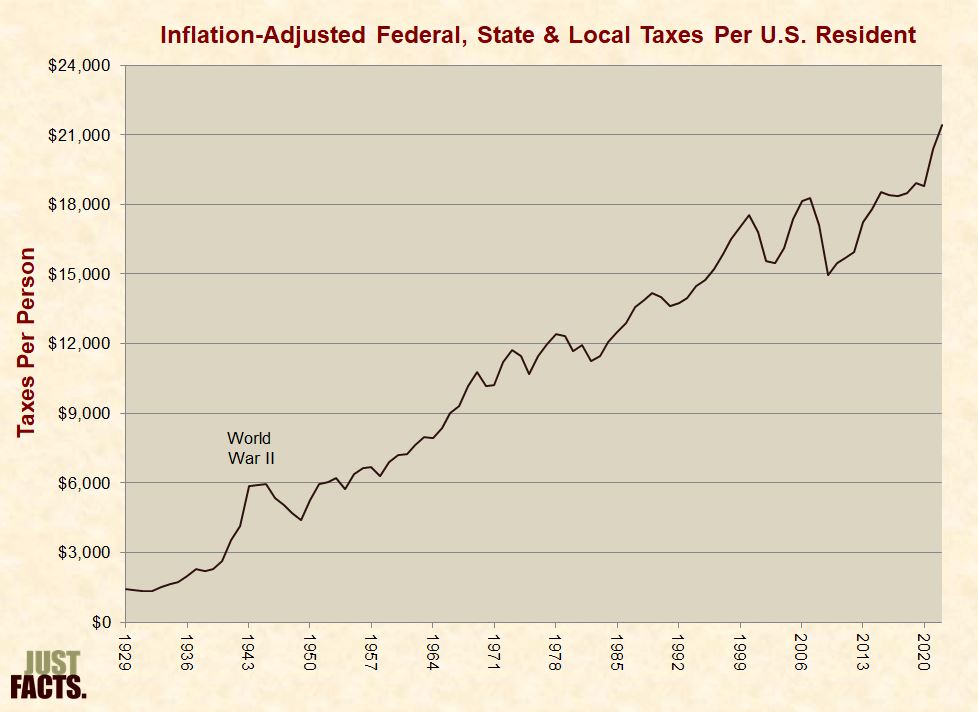

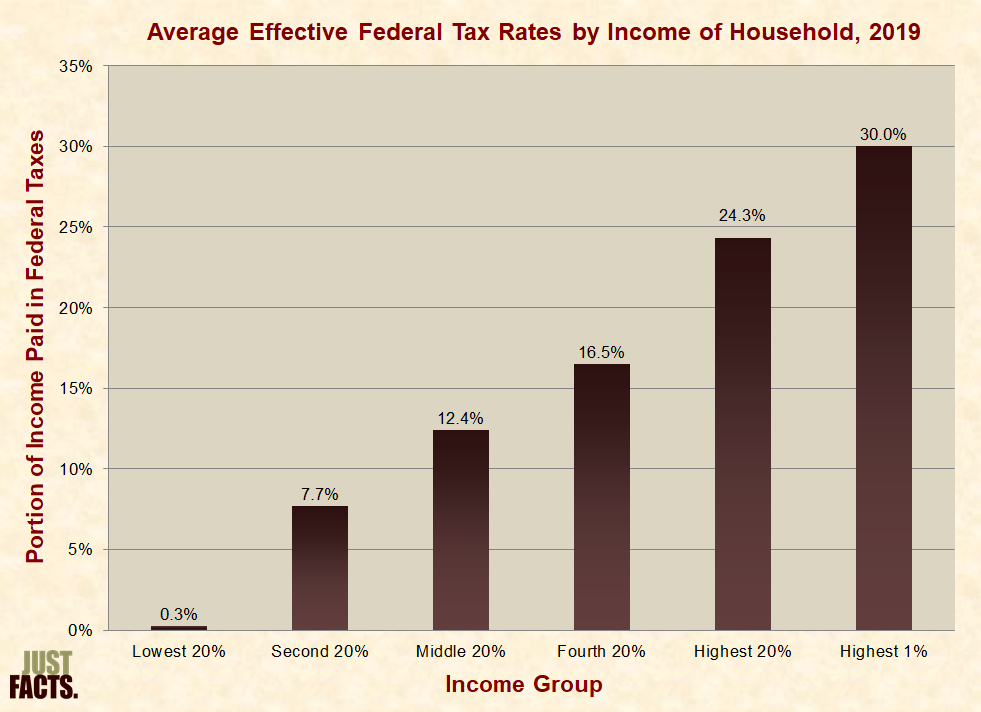

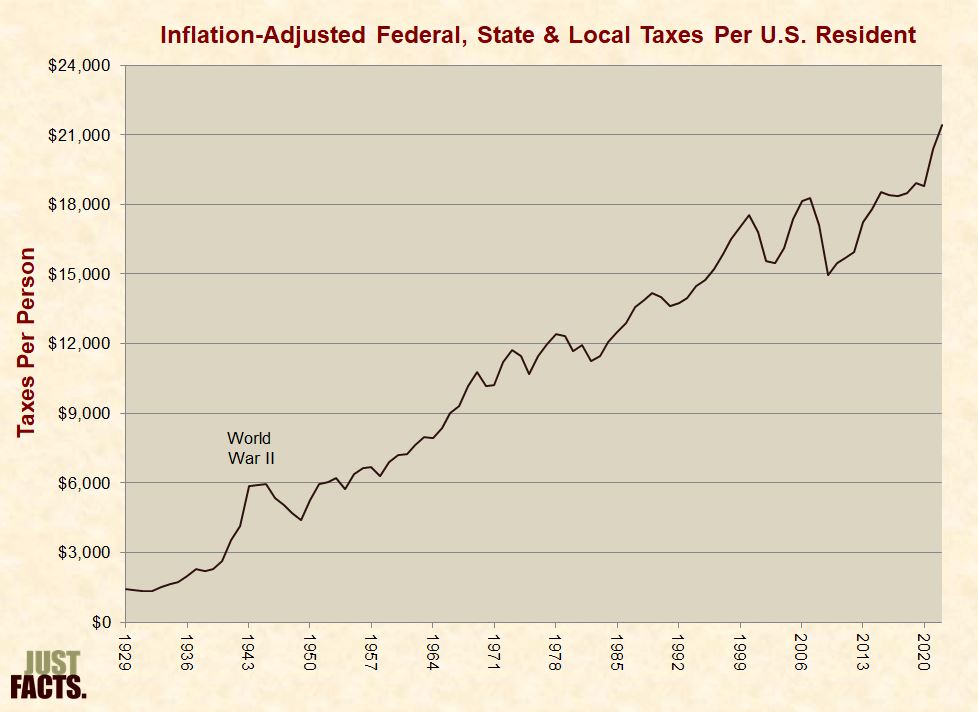

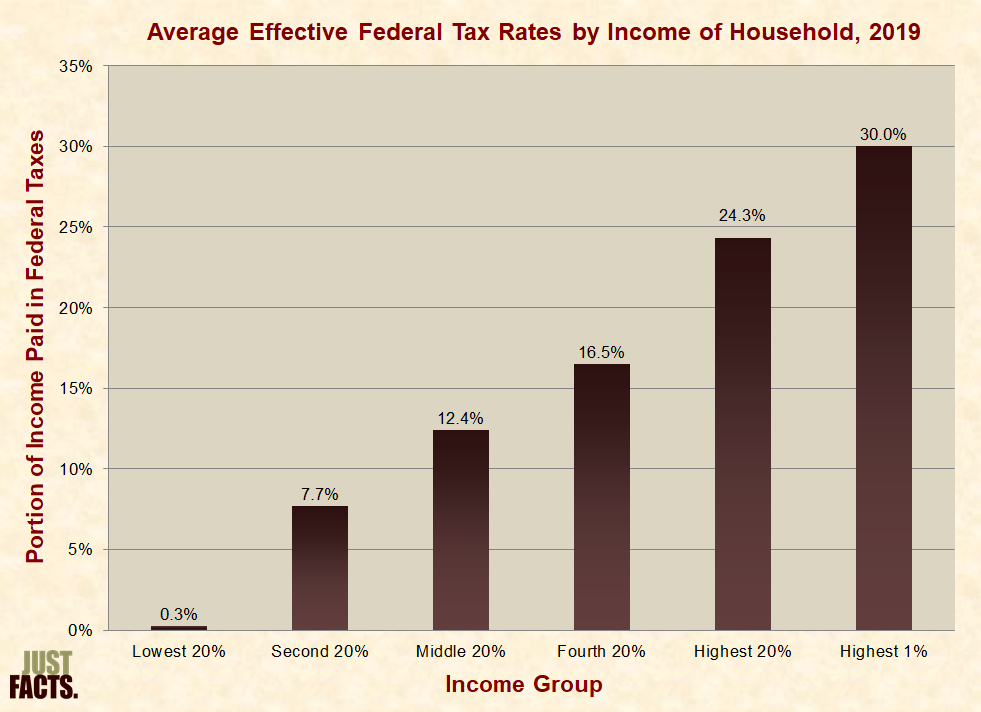

Taxes Just Facts

March 2015 Tax Expatriation

Searchable Pdf

Corporate Governance On Twitter You Want More Profits

How Does An Rrsp Contribution Reduce Your Income Tax

Understanding The New Kiddie Tax Journal Of Accountancy

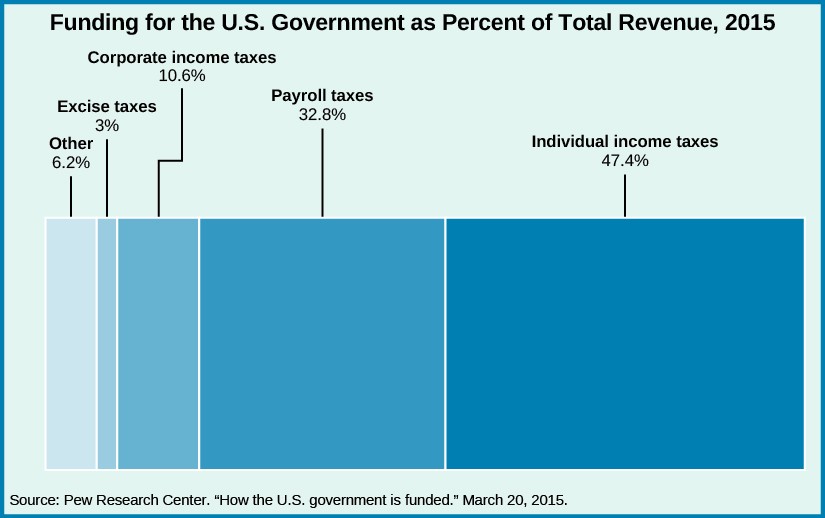

Budgeting And Tax Policy American Government

What Income Is Taxable Skb Accounting

University Of Mannheim Business School Dorrenberg

How To Pay Yourself As A Canadian Small Business Owner Kashoo

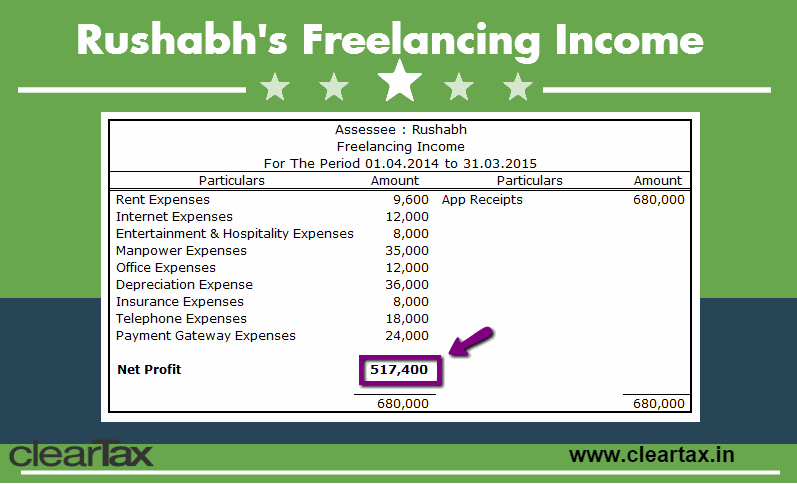

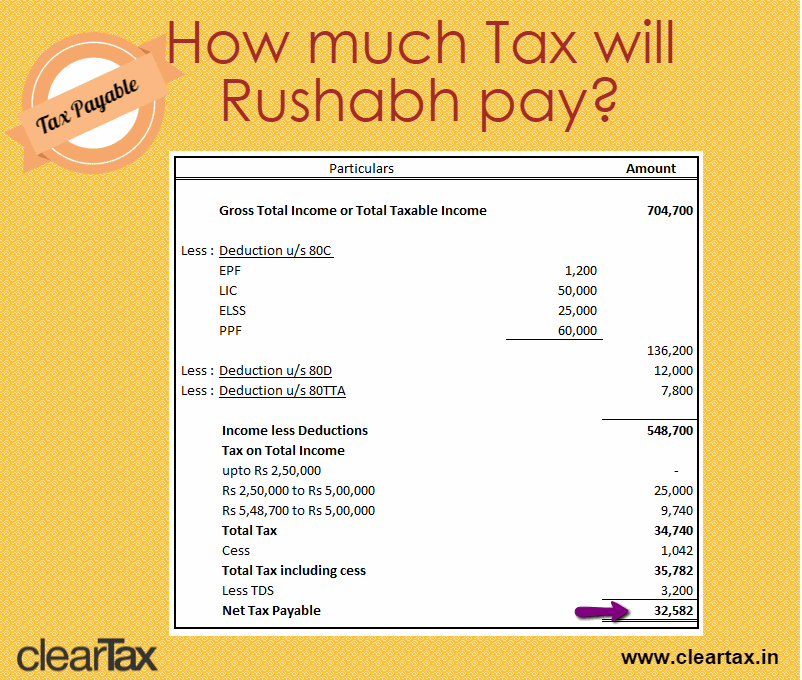

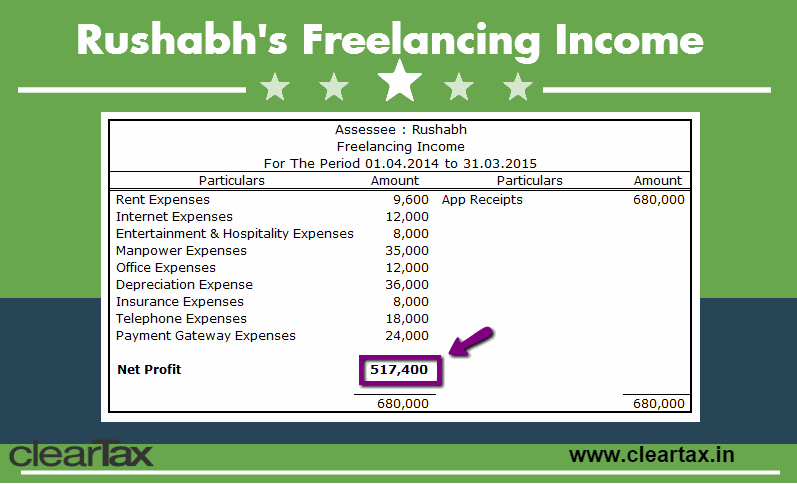

Freelancer S Tax Computation Expenses Total Taxable Income

Freelancer S Tax Computation Expenses Total Taxable Income

6 Factors That Affect How Much Income Tax You Pay Fox Business

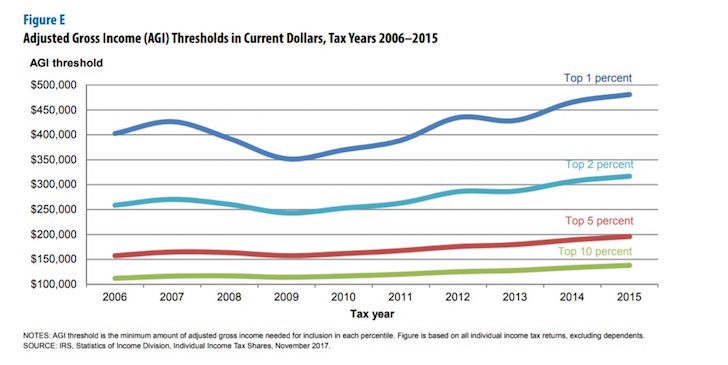

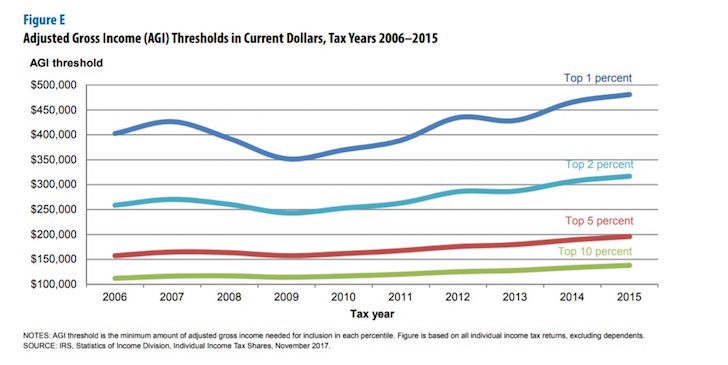

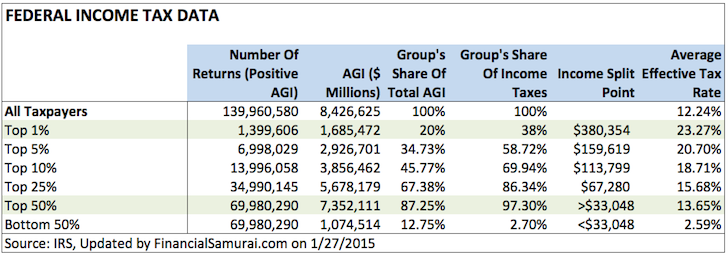

How Much Money Do The Top Income Earners Make By Percentage

Effects Of Income Tax Changes On Economic Growth

Letter Of Transmittal Ato Annual Report 2015 16

Taxation In Quebec 2019

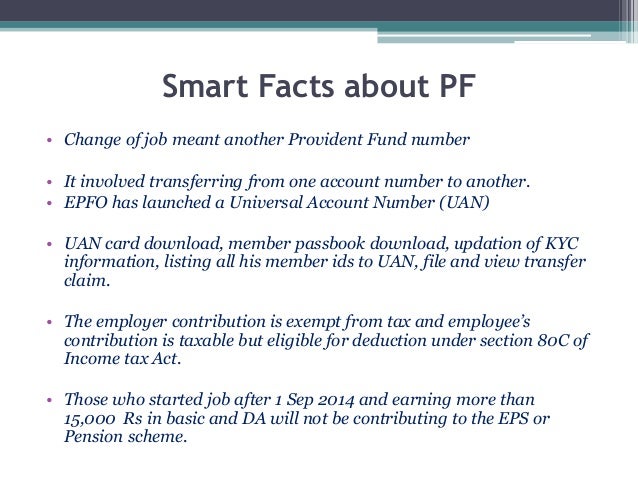

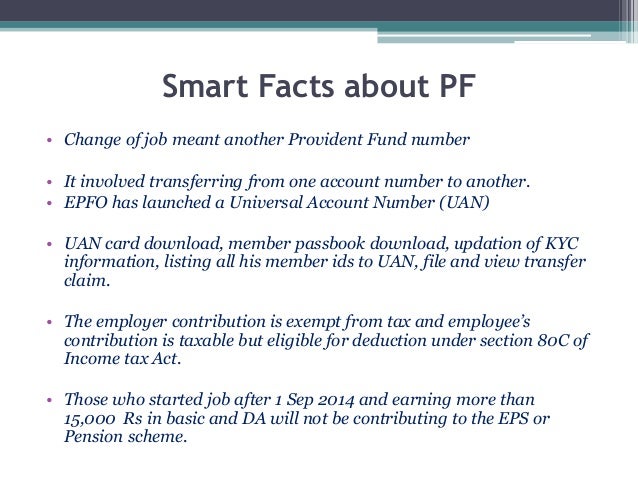

Why New Retirement Fund Rules Are Good News City Press

Amazon In Buy Systematic Approach To Taxation Book Online

:max_bytes(150000):strip_icc()/howmuchinsurancedoyouneedfiguringoutfinancialplanning-5a4309759e942700379224c7.jpg)

Tax Loopholes And How To Use Them

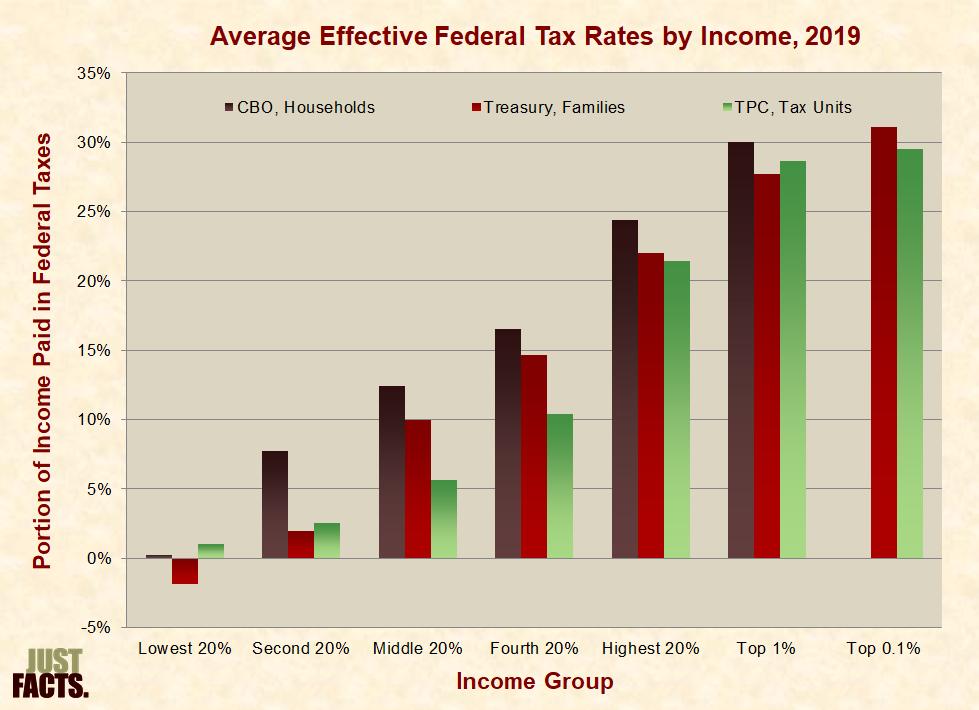

Taxes Just Facts

University Of Mannheim Business School Dorrenberg

Earnings Stripping Effective Tax Strategy To Repatriate

10 Surprising Items Irs Says To Report On Your Taxes

Happy National Jealousy Day Finland Bares Its Citizens

The Legacy Of The 2001 And 2003 Bush Tax Cuts Center On

Sugar Taxes The Global Picture In 2017

Berkeley Opportunity Lab Taxation Inequality

Happy National Jealousy Day Finland Bares Its Citizens

March 2016 Elders In Action

Untitled

2019 Nonprofit Tax Update Topics Treasury And Irs Eo

Water Taxation And The Double Dividend Hypothesis Global

Freelancer S Tax Computation Expenses Total Taxable Income

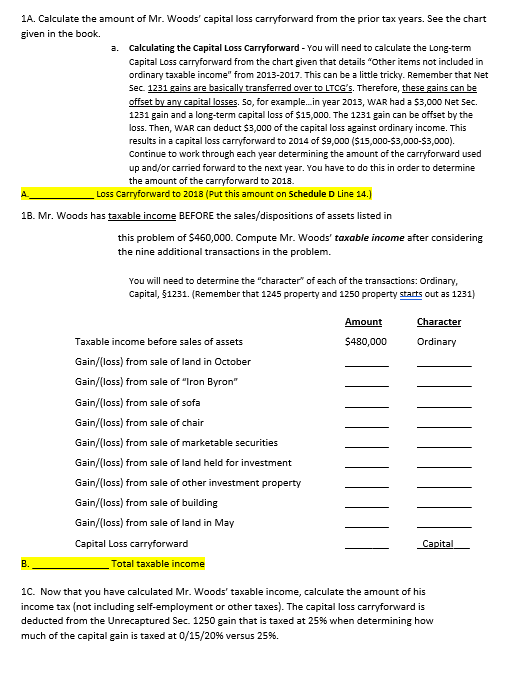

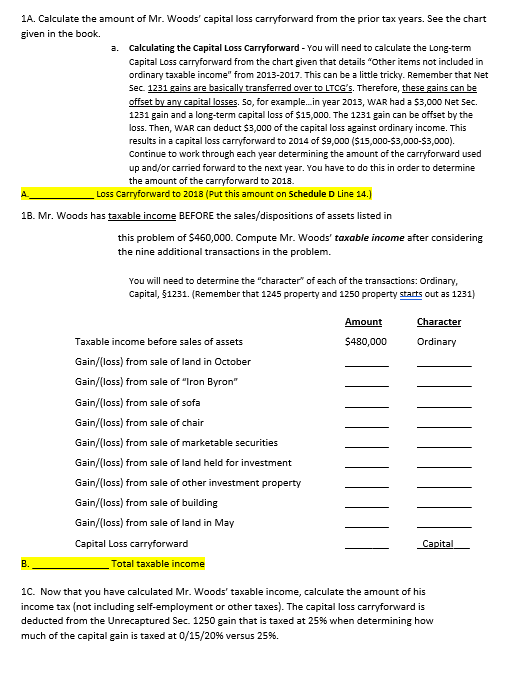

2013 2014 2015 2016 2017 Ordinary Taxable Income S

Question 1 Taxable Income Mr Allen Arnold Is 58

State Taxes Virginia

To The Honorable Tom Brower Chair And Members Of The House

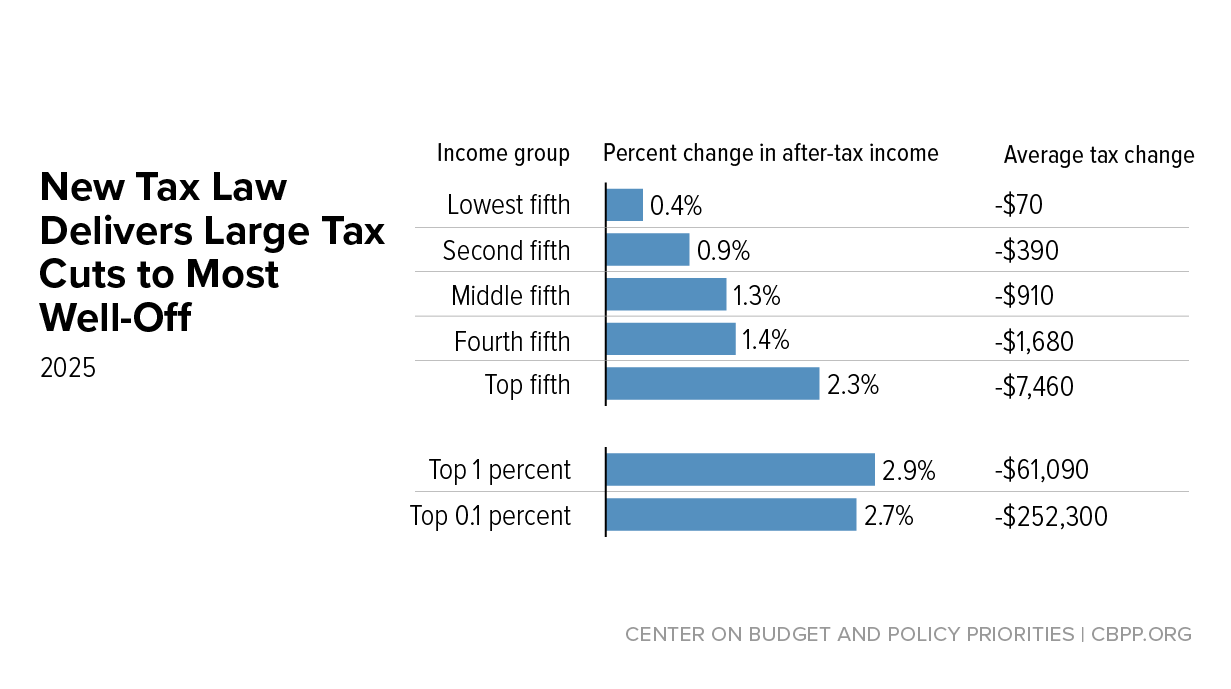

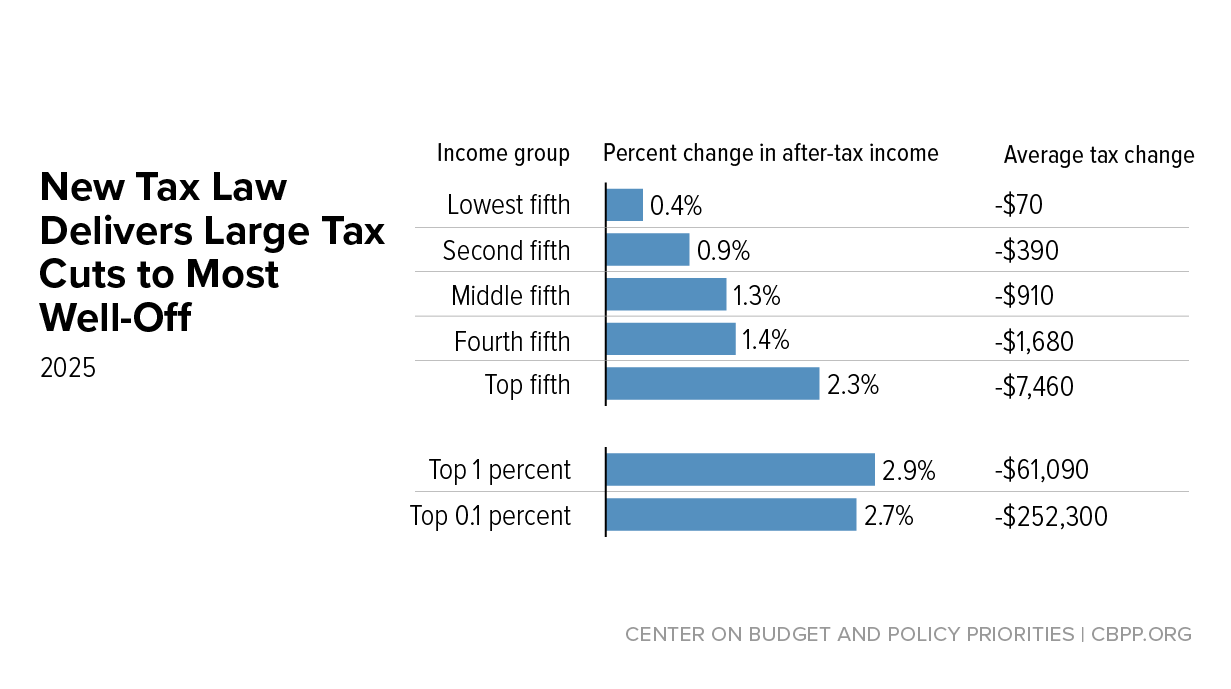

New Tax Law Is Fundamentally Flawed And Will Require Basic

Jointly Owned Property How Is Income Taxed

What Are The Tax Implications Of Investing In Mlps Market

Pay And Perks Of Indian Mp Mla And Prime Minister

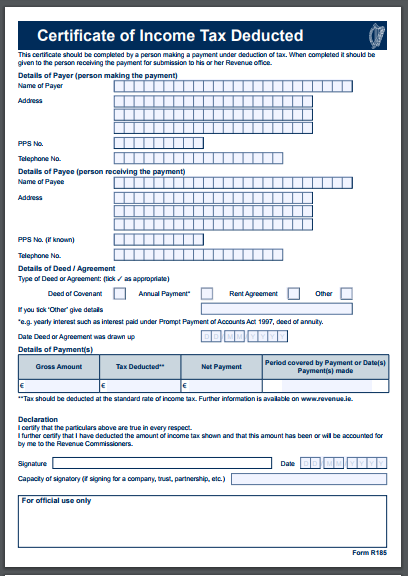

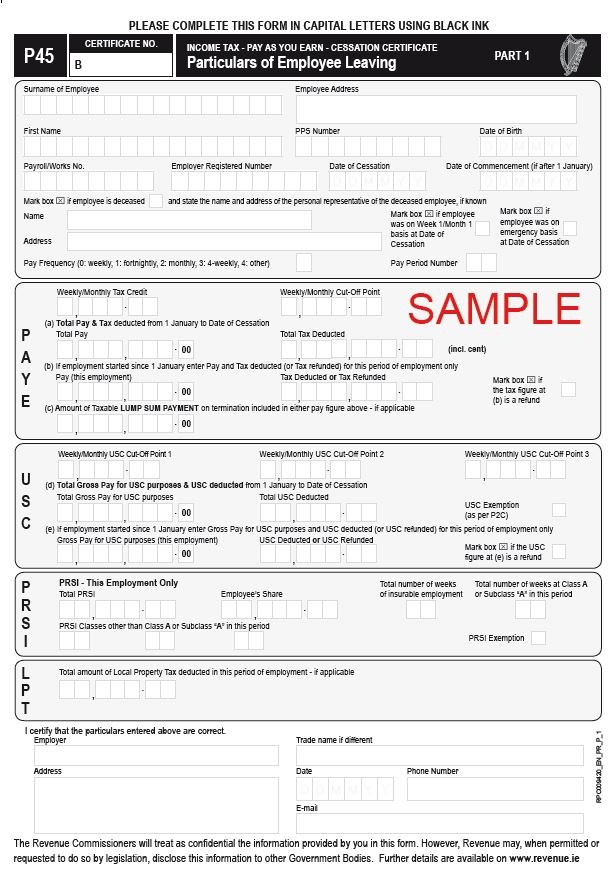

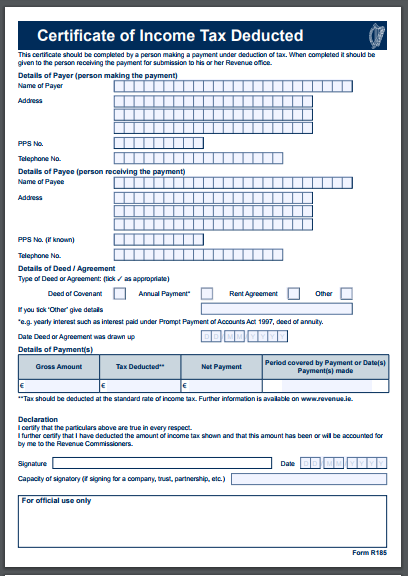

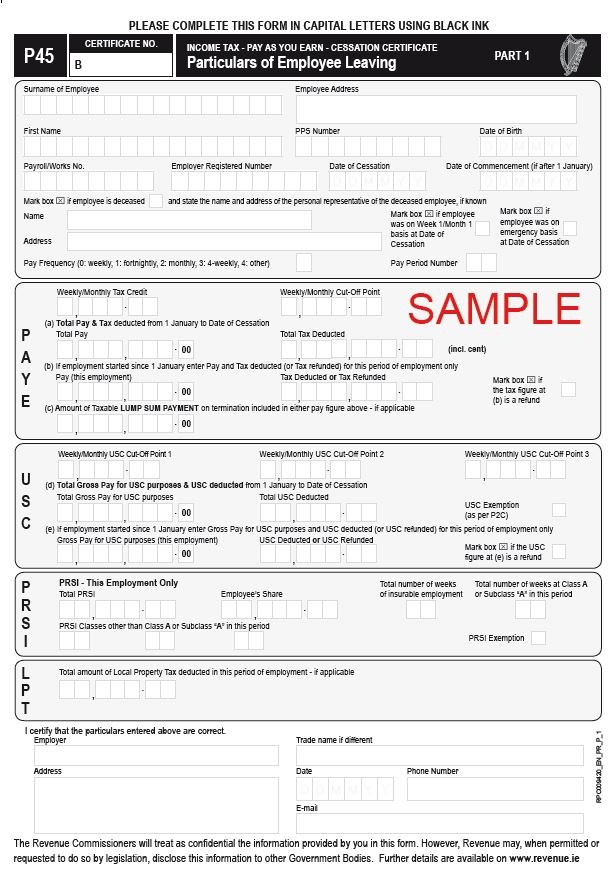

Simple Paye Taxes Guide Tax Refund Ireland

State Taxes Virginia

/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

Explaining The Trump Tax Reform Plan

Simple Paye Taxes Guide Tax Refund Ireland

Internal Revenue Bulletin 2014 16 Internal Revenue Service

New Tax Law Is Fundamentally Flawed And Will Require Basic

How Can A Developer Qualify For Capital Gain Treatment A

The Oregon Legislature Appears To Have Brought More Joy To

Untitled

2013 2014 2015 2016 2017 Ordinary Taxable Income 4000 2000

How Much Money Do The Top Income Earners Make By Percentage

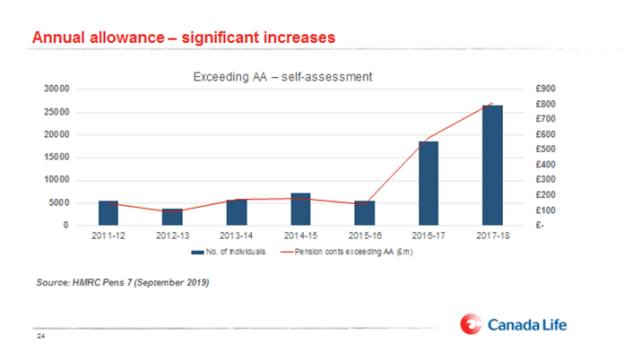

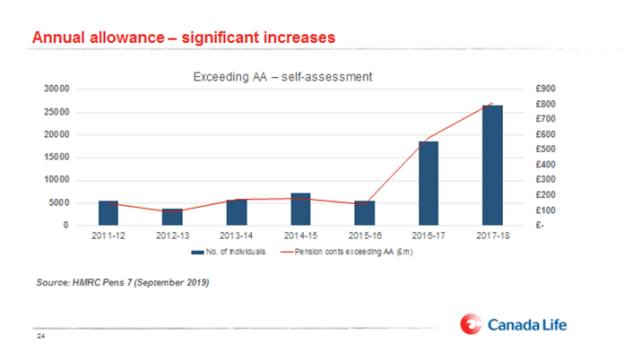

Pension Allowance Breaches Revealed Ftadviser Com

Corporate Tax In Germany Expat Guide To Germany Expatica

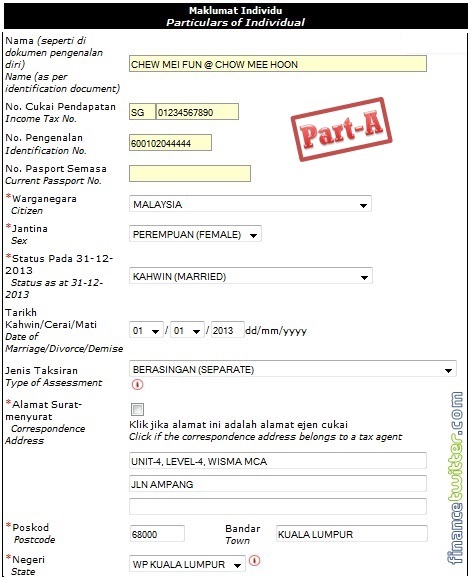

15 Tax Deductions You Should Know E Filing Guidance

Federal Board Of Revenue Fbr Government Of Pakistan

Tutorial Work 3 Acc20004 Financial Accounting Studocu

15 Tax Deductions You Should Know E Filing Guidance

Tax And Budget Policy Cato Liberty

Taxation And Investment In Mexico 2016

Splitting Specified Foreign Sourced Income Isca

Tax And Budget Policy Cato Liberty

Is My State Tax Refund Taxable And Why The Turbotax Blog

Are Retirees Hit By Labor S Policy And What Is A Wealthy

MemberFBRurgesoptimalutilizationofTaxAmnesty,rulesoutextension.gif)

Federal Board Of Revenue Fbr Government Of Pakistan

2013 2014 2015 2016 2017 Ordinary Taxable Income 4000 2000

The Gender Income Gap In More Than 1000 Occupations In One

Understanding The New Kiddie Tax Journal Of Accountancy

Pdf Are The New Polish Tax Rules Regarding Partnerships

What Is Form 4972 Tax On Lump Sum Distributions Turbotax

The State And Local Tax Deduction Cap Probably Isn T Going

How Should Capital Gains Be Taxed Wsj

A Tax Break For Dream Hoarders What To Do About 529

Supply Side Economics Wikipedia

How Should Capital Gains Be Taxed Wsj

Section 23 Taxes The Dyrdek Co Had 264000 In 2014 Taxable

What Are The Tax Implications Of Investing In Mlps Market

Understanding The New Kiddie Tax Journal Of Accountancy

15 Fortune 500 Companies Paid No Federal Income Taxes In

Rich People Are Getting Away With Not Paying Their Taxes

Millions Snared By Income Tax Traps Financial Times

Quebec Income Tax Rate The Third Highest In The Oecd Report

Events School Of Accounting And Commercial Law Victoria

Taxation Review Lecture Capital Gains Tax Tax Deduction

Freelancer S Tax Computation Expenses Total Taxable Income

15 Fortune 500 Companies Paid No Federal Income Taxes In

Taxes Just Facts

Multistate Tax Commission News

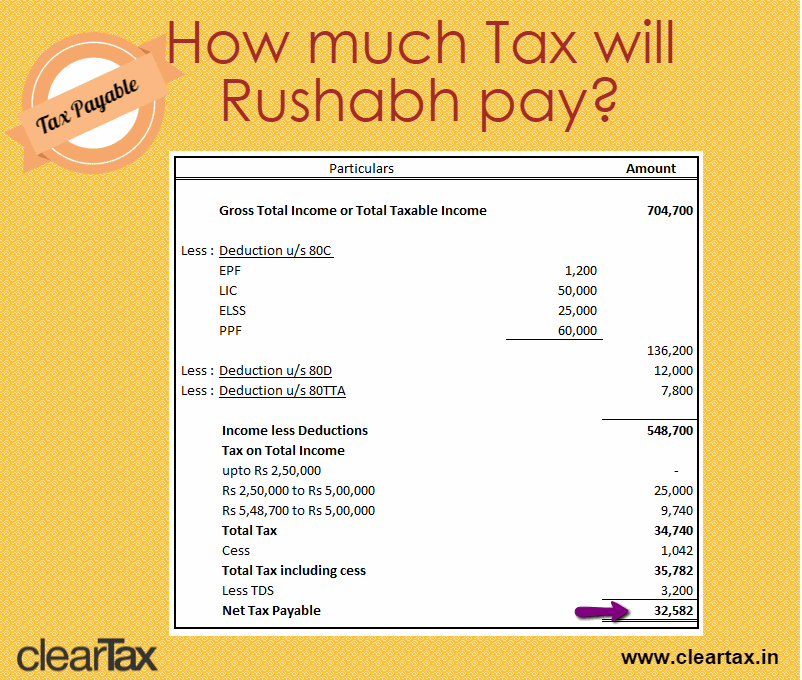

Calculation Taxable Income

Solved Fina 3320 501 Principles Of Finance Spring 2019 05

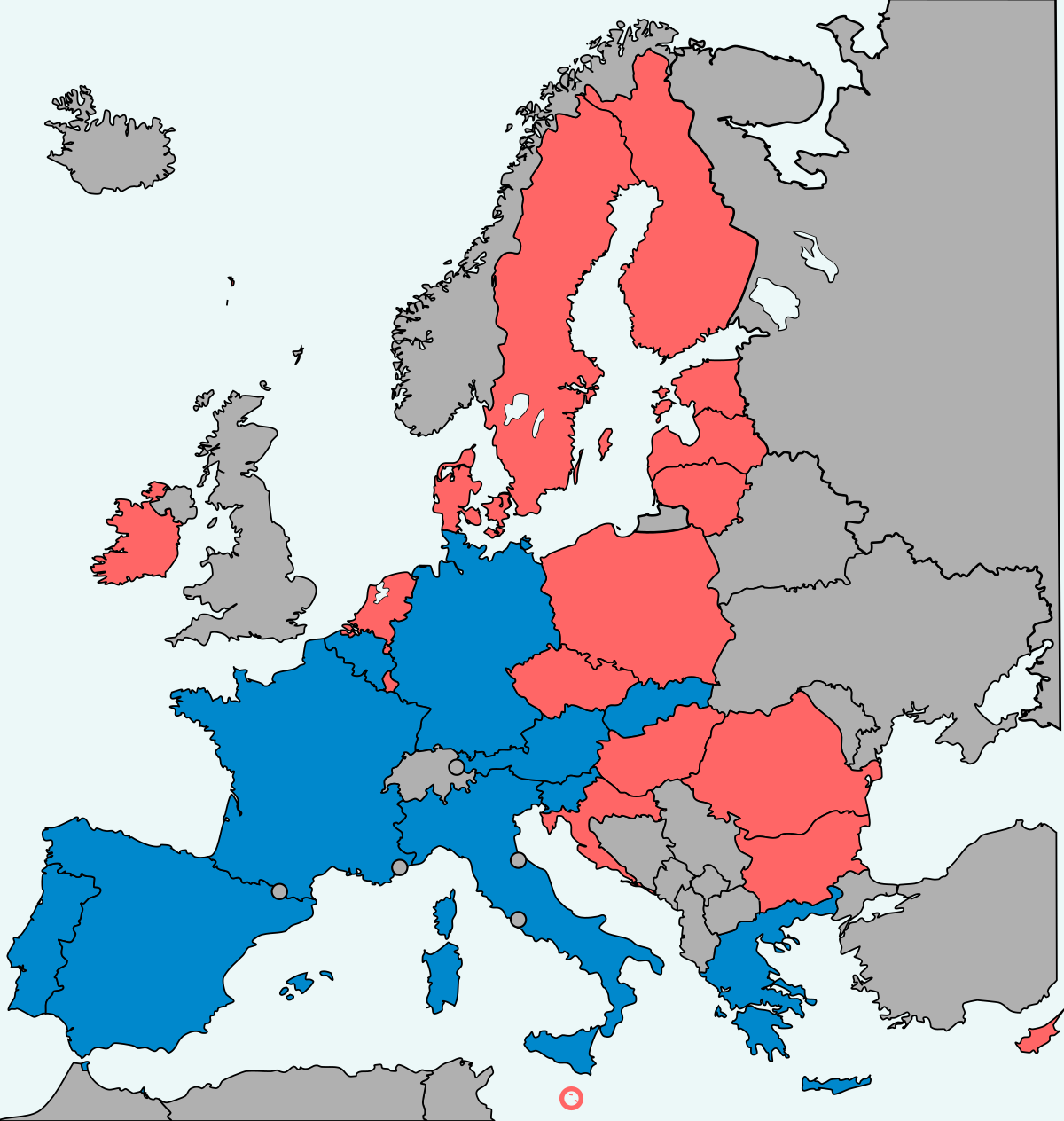

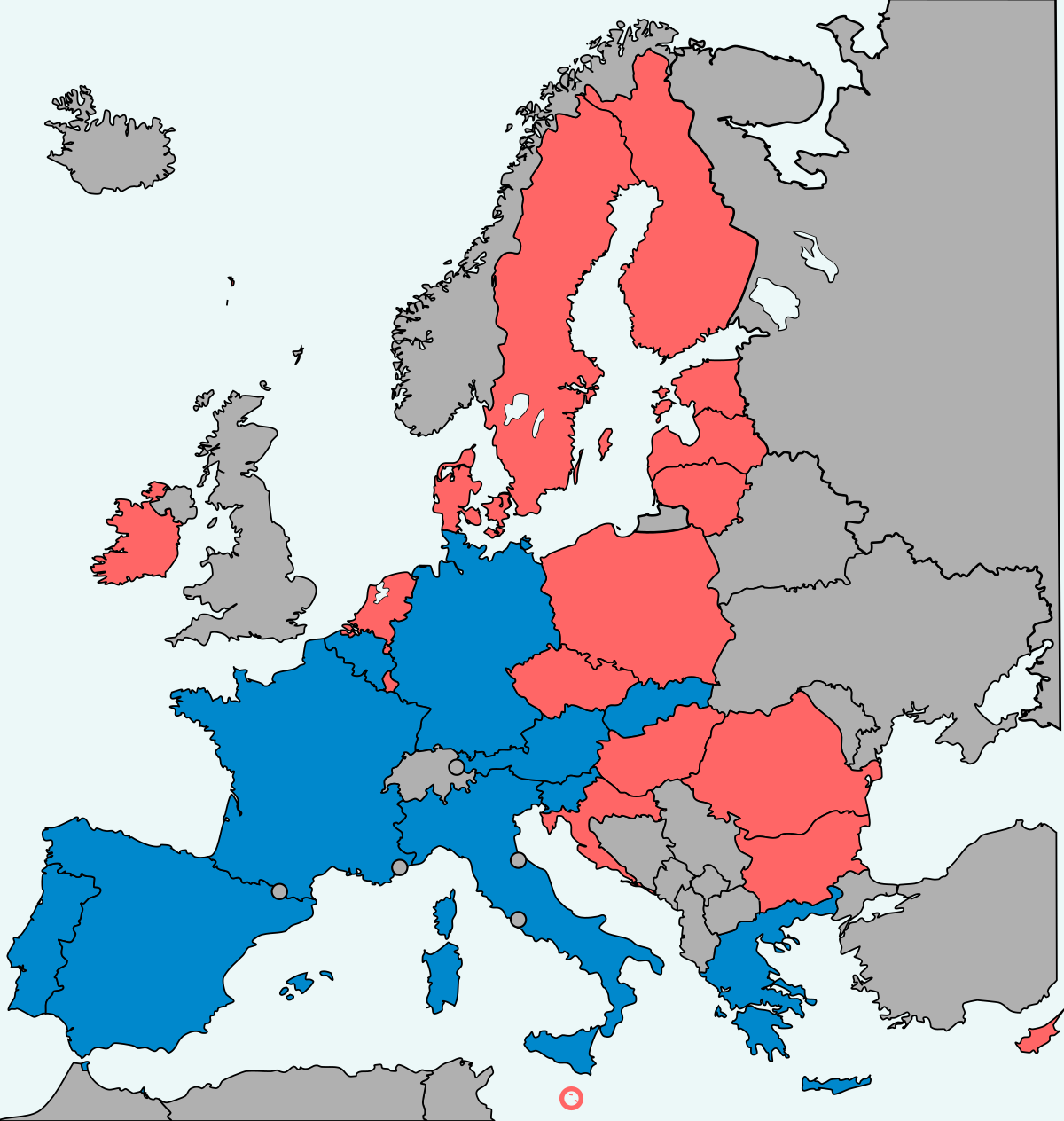

European Union Financial Transaction Tax Wikipedia

What Is Tds Tax Deducted At Source Meaning Certificate

Best States To Be Rich Or Poor From A Tax Perspective

:max_bytes(150000):strip_icc()/howmuchinsurancedoyouneedfiguringoutfinancialplanning-5a4309759e942700379224c7.jpg)

/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

MemberFBRurgesoptimalutilizationofTaxAmnesty,rulesoutextension.gif)